Fast Track To Paid Pilots For Fintech Startups: Raiffeisen Bank International’s Elevator Lab Comes Back With New Enhanced Design

Fintech companies from all over the world that develop solutions in the areas of database analysis and loyalty can apply for the new edition of Elevator Lab, the fintech partnership program of Raiffeisen Bank International (RBI). The two winners of the competition Analytics & Loyalty Solutions for Companies Track will receive a guaranteed and paid PoC within RBI’s subsidiaries in Bulgaria and Romania, and an opportunity for integration of the solution in the global network of financial institutions of the group. The program is aimed at companies at a later stage of development, who already have a product on the market.

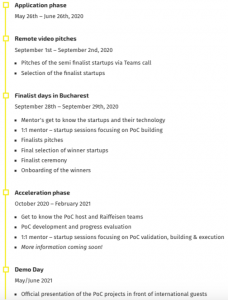

Applications are open until the 26th of June. Participation in Elevator Lab is also an opportunity for the development of Bulgarian projects with the help of experienced mentors and access to real business cases.

This is a significant redesign of the program based on the feedback and the experience of Raiffeisenbank and the teams leading its acceleration efforts at Elevator Lab.

“This year the combination of focused topics as well as the individual timelines of the Elevator Lab Partnership Program tracks will allow the local business units to better prepare for the pilot project and secure the necessary resources both on business and IT sides prior to the start of the Proof of Concept,” says Istvan Kovacs, Fintech Partnerships Manager, Raiffeisen Bank International. The new program features a Proof of Concept fund, that aims to cover founders’ costs for pilots within the banking group.

Two clear focus areas, access to IT departments and decision-makers early on

In the last years, the Elevator Lab Partnership Program was organized centrally, driven by RBI, and included several topics spanning from retail and corporate banking throughout to Regtech and IT security topics. In the end, five or six different startups were selected and given the opportunity to run a PoC either in Vienna or in some of the other network banks in the CEE region. This approach, however, slowed down the PoCs in some of the local subsidiaries as their teams were not involved in the process from the very beginning. Therefore, in this edition, the process is reversed – first focused PoC in the network banks. Тhis year multiple individual topics or “tracks” will take place, hosted by some of the network banks in RBI’s markers which provide Fintech startups with more opportunities to run a PoC in the RBI Group. The areas in which the bank is looking for innovations are narrowed to two.

“We emphasize the need to further dig into our data and make the most of it using Advanced Analytics and Loyalty solutions. The opportunities that a PoC offers are the possibilities for further partnership with Raiffeisenbank Bulgaria and the introduction of the company to the rest of the 13 CEE banks that are part of the group,” explains Yoanna Genova, Business Analyst Innovations, Raiffeisenbank Bulgaria.

“Creating more loyalty for our customers (our Corporate and SME clients) and also providing them with the proper solutions with which they can also grow their business is actually showing that Raiffeisen is not only a bank but a partner, interested in its clients’ evolvement,” adds Andreea-Luminita Porojan, Digital Transformation Specialist – Fintech Partnerships, Raiffeisenbank Romania.

Not least, in the 2020 edition, the IT and corporate finance teams at Raiffeisenbank in Romania and Bulgaria will be engaged with the innovation process from the beginning. This would assume that everyone ‘buys’ the innovation effort and is ready to commit to it. “There is an international pool of mentors – consisting of business, IT and operations experts from Raiffeisenbank Bulgaria, Raiffeisenbank Romania, and RBI – who are looking at the incoming applications, evaluate the Fintech proposals and potentially discuss possible use cases with them,” explains Istvan Kovacs. For instance, in Romania, the jury and mentor group includes executives and managers from several Corporate and SME business lines, the Advanced Analytics team of Lead Data Scientist, CRM team – specialized in building loyalty programs, and also Architects and Digital Specialists from the IT Team.

End goal PoC: What it looks like

In the course of the Elevator Lab, the Raiffeisenbank teams will run a 4-5 months long “virtual” PoC-s, which means that the Fintechs can work from home most of the time and meet physically their mentors in the bank only a few times with a predefined agenda and objectives. “We have many collaboration tools in place that enable and enhance cross-country collaboration and the quick exchange of information and data. However, we believe that the most important strategic decisions shall be discussed and elaborated on thoroughly – that is the reason why we not only support but also organize some dedicated onsite days for the Fintechs and the mentors, locally in the host country during the PoC phase,” explains Istvan Kovacs.

A PoC process sometimes happens quickly, sometimes it takes more time, depending on the current priorities of the respective business unit within the bank, as well as on various regulatory or technological difficulties.

One important detail in the corporate collaborations with startups is who pays the bill for pilots. This is also often a challenge to corporate innovation efforts. Elevator Lab addresses this too– the RBI’s program has a PoC fund in place. “We believe that a PoC fund is essential, on the one hand, to compensate the Fintechs for their effort they put in the pilot project and, on the other hand, to ensure the necessary commitment on both sides. In our experience, if something is done for free – it is rather “taken for granted” and the necessary attention is not given. As the rule of thumb, RBI Group engages in PoCs up to gross EUR 40k,” explains Istvan Kovacs.

Applications for the Analytics & Loyalty Solutions for Companies Track in Bulgaria and Romania are open till June 26th > Apply here.

In 2020, there are also programs with different topics running in different markets. RBI is running a Value-added Services for Large Corporates Track in Austria. More tracks will be announced soon.

This may also interest you:

Elevator Lab: Sometimes The Great Innovations in Banking Don’t Even Come From the Fintech Space

Elevator Lab Finals: Smartphones Become POS Terminals. And That’s Just The Beginning

LogSentinel: Raiffeisen tests integration with Bulgarian blockchain startup