2020 Ecosystem Recap: How Greek Startups Grew During the Pandemic

Last year was marked by tremendous shocks in the global economy. The COVID 19 pandemic that hit practically all countries in the world, not only hindered market development but threatened to kill many industries forcing entrepreneurs to urgently modify their plans for the future. At the same time, the crisis was an opportunity for small businesses and startups that proved ready and willing to work hard in the tough times we were faced with. What happened in the Greek startup ecosystem, who were the big winners and how did the industry develop despite all odds? Read on to see the findings of the latest Found.ation and EIT Digital report.

Top performers grab the lion’s share of investments

In 2020, Greece’s top 10 startups raised EUR 115 million of the EUR 150 million invested in the ecosystem.

The list, based on investments made within the framework of the Greek EquiFund financing program, is topped by SKROUTZ, an award-winning digital brand that operates Greece’s leading comparison shopping engine. The amount of funding attracted by the platform has not been revealed officially but is believed to be substantial.

Omilia, a provider of enterprise-grade Natural Language Understanding technologies, comes in second with funding worth EUR 17.4 million, followed by TileDB, a universal data engine that allows data scientists to access, analyze, and share complex data with any tool, with EUR 12.5 million.

Fewer startups get more funding

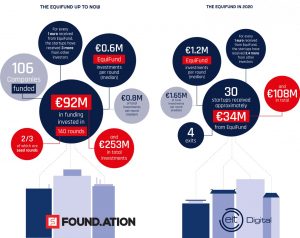

2020 saw a lower flow of startups to the funds (30 vs 48 in 2019) with the amounts invested under the EquiFund remaining roughly the same. However, companies that eventually got funded sought and attracted more money. The majority of them (31.57%) have requested an amount between EUR 500k – 1m (while in 2019 the same amount accounted for 15% of the startups), while the ask amount of up to EUR 100k has been narrowed down to zero compared to 2019. Similarly, the share of idea-stage startups requesting EUR 1m+ has increased from 10% in 2019 to 21% in 2020.

This trend signals an important development in the Greek ecosystem marking its gradual evolvement into maturity despite the pressure of the COVID 19 pandemic.

2020 was also a record year for exits, registering the largest acquisition of a Greek startup (Instashop for € 307 million), another exit exceeding € 100 million (acquisition of Softomotive by Microsoft), and the first exits of companies funded through EquiFund (Pushme, Instashop, Think Silicon, GuestFlip).

COVID-19 bites – not really

The first modern life pandemic inevitably impacted the startup ecosystem in Greece causing some shifts in investor interest and operation plans. This caused problems but also opportunities for startup founders, particularly in HealthTech, which tops the list of startups in pre-seed and seed stages. Their share in the pool increased nearly twofold growing from 9.25% in 2019 to 16.16% in 2020 on the back of notably higher interest in telemedicine and diagnostics.

They are followed by retail and e-commerce with 10.17%, another industry that thrived during the extensive lockdowns imposed by governments around the world. Lifestyle, Social/Entertainment (Fashion, Sports, Gaming, Media, Social Networks) come in third with 9.58%.

A short survey carried out by the authors of the report startup founders said the COVID 19 pandemic showed an impressive 40% of startups hired people during the crisis, while only 26% had to do some layoffs. Asked to rate the impact of the pandemic on their business on a scale from 0 to 10 with 0 being the lowest, nearly 30% indicated a range from 0 to 2.

The future looks bright

Greek startups seem positive about their future prospects on the back of the large-scale government and EU support measures and interest on the part of VCs and angel investors. Notably, Greece is set to receive €13.5 billion in grants from the EU Recovery Fund over the next two years, making it the biggest recipient across the EU-27 relative to its GDP.

Experts are also optimistic.

“In a year globally dominated by COVID-19, Greek startups proved not only resilient but also flourishing,” commented Metavallon founding partner Myrto Papathanou, noting the serious flight to quality for Greek startups and the local technology environment. . It is indicative that 2/3 of the active VC investments in Greece, are at the moment in startups developing defensible, proprietary technology or in deep tech. This is a stark contrast to what was getting funded only a couple of years ago,” she added.

“The Greek startup ecosystem has grown from almost nothing, just eight years ago, to €3.5 billion today. There has never been a more exciting time to invest in the Greek startup ecosystem,” said entrepreneur and angel investor Marina Hatsopoulos Entrepreneur from Windystreet.com.