AI investments and the 500 (!) billion dollar gap

Nvidia’s GPUs are selling like hotcakes, Apple and Microsoft are fighting over OpenAI, and VCs pumped a whopping $27 billion into AI startups between April and June: It’s no secret that artificial intelligence is experiencing an unparalleled boom. But what is secret is: are AI tools, which are being upgraded with billions, also generating revenue? David Cahn, partner at one of the most important VCs in the world – Seqoia Capital – sees a gaping gap of a whopping $500 billion between the expected and actual revenue from AI.

Google Environmental Report 2024: AI as an extreme CO2 emitter

Cahn had already pointed out this gap before – and estimated it at around $125 billion in September 2023. Less than a year later, in July 2024, it is four times as large. An updated analysis by David Cahn now shows that the gap between the revenue expectations resulting from the development of AI infrastructure and the actual revenue growth in the AI ecosystem has multiplied.

Several factors have changed since September 2023: The shortage of graphics processing units (GPUs) has eased, GPU inventories are growing, OpenAI still has the lion’s share of AI revenue (reported at $3.4 billion extrapolated over 12 months), and the gap between revenue expectations and actual revenue has widened from $125 billion to $500 billion. In addition, Nvidia’s new B100 chip is expected to be the successor to the H100, which should further fuel demand.

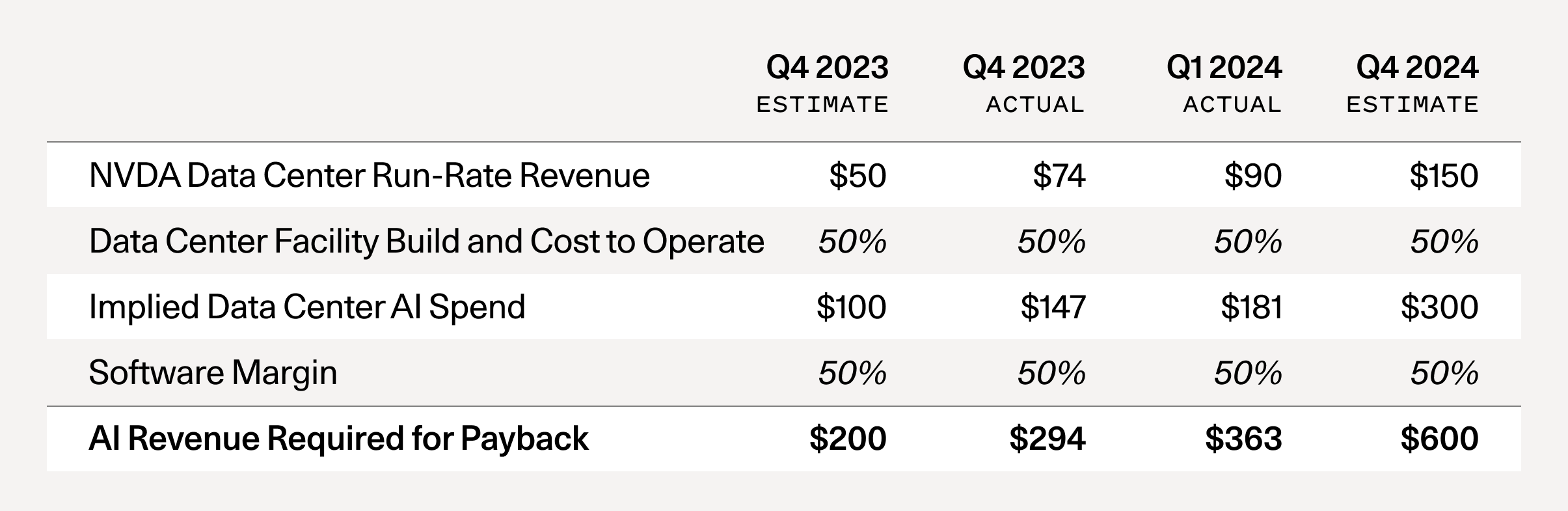

Here are Cahn’s calculations showing how much revenue would have to be made with AI to earn back the investments that were made:

Several observers and analysts have already warned that AI could develop into a huge bubble. There have been and continue to be comparisons between the rapidly rising stock market values of Nvidia, Microsoft, Apple, Meta and Google in the AI hype, and the low sales of AI that contrast with this.

“We have to be careful not to fall into madness”

“In the last analysis, I generously assumed that Google, Microsoft, Apple and Meta will be able to generate $10 billion in new AI-related revenue annually. I also assumed that Oracle, ByteDance, Alibaba, Tencent, X and Tesla will each generate $5 billion in new AI revenue. Even if that stays the same and we add a few more companies to the list, the $125 billion hole is now a $500 billion hole,” said Cahn. Seqoia is one of the major investors in Nvidia, Google, Apple, and Instagram.

Nevertheless, the Seqoia partner is optimistic about AI developments, it’s just that they will take longer than some think. “Speculation is part of technology. Those who keep a cool head at this moment have the chance to build extremely important companies. But we have to be careful not to fall into the madness that has now spread from Silicon Valley to the rest of the country and even the world. This madness says that we’re all going to get rich quick because AGI is coming tomorrow and we all have to hoard the only valuable resource, namely GPUs,” says Cahn. “In reality, the road ahead of us will be a long one. It will have ups and downs. But it will almost certainly be worth it.”