An Introduction To Decentralized Finance: Blockchain’s New Killer Use Case

Into blockchain technology since 2013, Vladislav Dramaliev is one of the founders of the Bulgarian crypto community. Head of Communications in the æternity blockchain project for three years, Vlad is currently focused on his crypto donation platform BitHope.org, the monthly Sofia Crypto Meetup event, and Decentralized Finance applications.

In short:

- Although it’s a promising technology, public smart contracts haven’t delivered much real-world utility so far. The decentralized finance (DeFi) movement is rapidly changing that.

- DeFi applications are live and give internet worldwide users permissionless access to more transparent, efficient, and automated financial services.

- But are DeFi protocols secure enough and how will regulators react to the legal innovations they introduce?

“What have smart contracts really achieved so far?!” a friend of mine, who’s indeed quite interested in blockchain technology, asked me a year ago. “Apart from a few significant hacks, Ponzi schemes, the irrational exuberance of the Initial Coin Offering (ICO) craze, and a few niche applications that mainly developers use? What is their “killer app”?”

A fan of sci-fi novels, cranky new gadgets, and imperfect technological solutions, I was more sympathetic towards smart contracts. There are thousands of people worldwide that are continually improving the tech. New levels of maturity are being reached daily, enabling new functionalities and empowering projects in the space to offer better services. I couldn’t speculate on the “killer use case,” but my educated guess was “something related to finance.” After all, blockchain technology was developed to disrupt the traditional financial system by decentralizing and disintermediating it.

A few months later, decentralized finance projects started to make headlines.

What is Decentralized Finance?

In the broadest possible terms, public blockchain infrastructure is the tool that enables decentralized finance.

Bitcoins and altcoins are money/assets, the miners and nodes are clearinghouses, the platforms are payment systems, the wallets are accounts, the smart contracts are the intermediaries.

Bitcoin was the first decentralized finance project, and the goal of its creator was to prove that just like information, money and finance can and must be disintermediated.

More specifically, decentralized finance is the term used to describe a group of projects mainly based on Ethereum, whose aim is to recreate traditional financial services on a blockchain. The goal is to make finance more accessible, open, transparent, secure, efficient, and non-custodial. Decentralized finance is also referred to as open finance, crypto banking, non-custodial finance, and solely as DeFi.

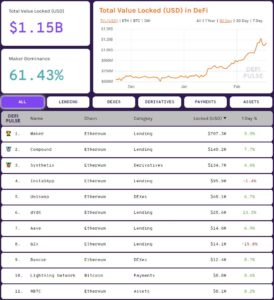

The best part of decentralized finance applications is that they are live and usable. One can simply go to the popular DeFi Pulse website to get a quick overview of the ecosystem (non-exhaustive list), select a project, and start interacting with it through a MetaMask wallet (most convenient).

What are DeFi apps used for?

The second-best part about DeFi apps is that they address pain points that even mainstream users experience. Using DeFi apps, users can:

- Make use of much higher interest rates on deposits than those offered by banks (interest rates on all DeFi lending platforms are dependent mainly on DAI’s stability fee, which in turn is affected by the price of ETH – bullish ETH sentiment results in higher interest rates and vice versa).

- Initiate or receive payments in tokens whose value remains stable (AKA stablecoins).

- Borrow cryptocurrencies and tokens without a centralized counterparty.

- Exchange cryptocurrencies and tokens without a centralized counterparty.

- Open short or long positions without a centralized counterparty.

- Get exposure to price movements of commodities, stocks, and indexes without a centralized counterparty.

- Use all of the above without going through a KYC/AML process and sharing personal data.

Here is a quick example to illustrate the point about interest rates:

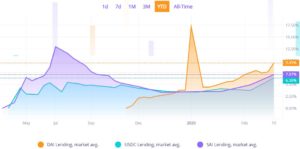

One of the most obvious benefits of DeFi becomes apparent from the graph above, especially if compared to the rates that the European Central Bank has offered since 2009:

Daily Level, ECB Deposit Facility

From a technological point of view, the DeFi ecosystem is entirely based on open-source protocols implemented by smart contracts. DeFi applications are “software” that anyone can examine, use, copy, and interact with. That’s literally the opposite of how the traditional financial system works.

These smart contract protocols perform three essential functions enabling the DeFi movement: non-custody; asset creation, pooling, and distribution; and composability. What do these mean?

Non-custody – A Technological and Legal Innovation

One of the innovations in the DeFi space is separating “custody” from “natural or legal person.” This is as much a technological novelty as it is a legal one.

In traditional finance, custody refers to a service in which a bank, brokerage, or other financial institution holds securities on behalf of the client. Offering custody in the crypto space has been particularly problematic due to the requirement to securely manage “private keys” and fulfill regulatory requirements

In DeFi, the custodians of users’ funds are neither legal nor natural persons but smart contracts. Programs residing on a public blockchain, whose sets of instructions are secured by cryptography and human ingenuity, assume the role of the middlemen. And this is disruptive. No entity other than a smart contract manages the private keys that provide access to more than a billion US dollars of value.*

Yet, an important question could be raised: Has technology advanced so far as to allow us to replace the functions of heavily regulated legal entities that have existed for hundreds of years?

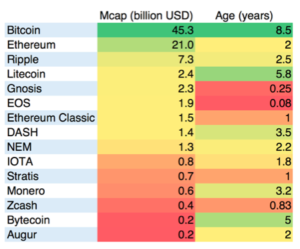

Much of the value of the Bitcoin network is derived from the fact that it remained secure for more than eleven years, despite its code being fully transparent and public. This refers to the concept of antifragility, stating that “the older something gets, the more likely it will continue to stick around.” In the case of Bitcoin, “sticking around” can be linked to “value” (market cap).

Is Bitcoin Antifragile? by Nic Carter (published in 2017)

The same is true for DeFi projects. They are fully subject to the constant extinction pressure on assets and protocols exhibited by cryptocurrency and token markets. That pressure is exerted simultaneously on several fronts. The two most important ones being the technological (security and reliability) and the regulatory one (can regulators shut us down?).

It is not a coincidence that the DeFi project that has been around the longest – Maker, is the one that currently accumulates most of the value in the space. Maker is also the only DeFi project whose “admin key” implementation relies on community governance.

An admin key enables partial or full control over a smart contract. In the case of Maker, if force majeure circumstances manifest themselves, it is the community of MKR token holders that decides how the admin key will be used. All DeFi projects intend to apply this approach eventually, but for the sake of upgradeability and security, they haven’t done so yet.

Access to admin keys exposes most DeFi projects to regulatory scrutiny. After all, if one controls the smart contract, then that contract is not really non-custodial. It remains to be seen how regulators perceive the concept of “non-custody” and its varying implementations. Could they consider the natural or legal entities behind DeFi projects to be the de facto custodians? It is possible. What effect will that have on the projects? What if the admin key is destroyed?

Regulators should consider the fact that in the absence of an admin key, a smart contract will continue to function as long as it provides utility to the users, and the underlying blockchain remains operational. Shutting down a piece of code on a public blockchain is not trivial. That’s why they are called “unstoppable applications” (Ethereum’s original value proposition).

How Does DeFi Work: Like ICOs, But Not Quite

Most people who have participated in an ICO have made use of this automation service offered by smart contacts. Usually, the process goes as follows:

The user acquires ETH > the user sends ETH to the public address of the smart contract > the smart contract receives the ETH > the smart contract mints new tokens based on a pre-programmed ratio > the smart contract sends the tokens back to the address, which sent the ETH.

In DeFi, that function of smart contracts is upgraded and repurposed. Let us consider the process of lending tokens using Compound to exemplify that point. Here are the steps that users take to lend DAI, the most popular programmatic stablecoin, and earn interest:

The user acquires DAI (from an exchange) > the user sends DAI to the address of the non-custodial Compound smart contract > the smart contract receives the DAI and makes it available for borrowing by other users > the smart contract mints cDAI based on a ratio calculated in real time >the smart contract sends the cDAI to the address which sent the DAI.

It is really the same process, but with two crucial differences:

- The user can, at any time, withdraw the DAI in exchange for cDAI.

- The ratio between cDAI and DAI is calculated in accordance with a formula that is hardcoded (meaning unmodifiable) in the smart contract. That cannot be changed even with the Compound’s admin key. The formula guarantees that cDAI will always appreciate. That means if a user has lent 10 DAI and has received 200 cDAI from the smart contract, in time, that 200 cDAI will be able to redeem more than 10 DAI. That’s how accrued interest on deposits is distributed to lenders – programmatically.

There is another important innovation that DeFi introduces. It was hinted at in step #3 of the example DAI lending process above (note the italics). To avoid the inconvenience of having to operate an off-chain order book that matches the orders of lenders and borrowers, and to make borrowing more flexible, DeFi projects rely on the concept of “pooled assets.”

Just like in the case of ICO-serving smart contracts, all tokens received from DeFi lenders are pooled together in the non-custodial smart contract. That effectively turns the contract into a single entity that manages the assets and is able to act as a lender to all individual borrowers. That makes it possible for any borrowing request to be matched, up to the size of the total “pooled amount” available in the smart contract.

Considering the graph below, one can ascertain that users can borrow any amount of DAI up to USD 34.48m.

It is fascinating how similar smart contract functionalities could power apps with entirely different risk profiles. Lending and borrowing cryptocurrencies is generally much less risky than investing in ICO projects.

Composability

The final function of smart contracts that empowers the DeFi movement relates to interoperability. Since DeFi contracts on Ethereum are standardized, public, open-source, and anyone can interact with them, they can be connected to one another, expanding their utility. Just like a software library, smart contracts for different financial applications can plug into each other like lego pieces. This helps the DeFi ecosystem to become exceedingly interconnected, enabling developers to build on top of existing functionalities, expanding them further. That supercharges the ecosystem, allowing new projects to develop at a more rapid pace. Interconnectedness also introduces “single point of failure” risks, but those will be considered in future articles.

Credit: DeFi Bulgaria

One of the projects that exemplifies composability well is PoolTogether – a “no-loss savings game” (basically a lottery, but the wording is important for regulators – ed.n.). Using the PoolTogether smart contract, users pool their DAI or USDC tokens together. 1 DAI is equal to 1 lottery ticket. The total value of the pool is then automatically lent to the Compound smart contract to generate interest. The more significant the pooled amount, the higher the interest earned. After a week, a random winner that is drawn receives all the accrued interest. The winner can also withdraw their DAI in full.

There are numerous other examples of DeFi composability. Most of those involve much more complex automated processes. For the most extreme example of composability, have a look at flash loans.

The Future of DeFi

Just like my friend, DeFi critics focus mainly on the current state of the ecosystem, frequently dismissing it because “it is not really decentralized.” But this could be a short-sighted perspective.

Similarly to Bitcoin and other valuable projects in the blockchain space, DeFi protocols are continually evolving. As the technology matures and the incorporated security and economic models prove their sustainability, DeFi projects will move further up the decentralization spectrum. There will most definitely be hacks and hostile regulatory action, but those are the standard growth risks in the blockchain space.

What is most important is that the DeFi smart contract protocols are operational today, solve real problems, and could function without a centralized entity behind them. They empower internet users worldwide by enabling permissionless access to more transparent, efficient, and automated financial services, shunning centralized financial institutions. Just like Satoshi imagined it.

___

* To deal with force majeure situations most DeFi projects keep an “admin key” that can be used to control the smart contract. For more information on how admin keys are implemented in some of the more popular DeFi projects, consider this table.