Artificial Intelligence in Decentralized Finance

In short:

- Using buzzwords to maximize the efficiency of fundraising was a common trend during the ICO craze of 2017.

- Three years later, after countless unfulfilled promises, it may be time to get excited about the intersections of technologies such as artificial intelligence (AI), machine learning (ML), internet-of-things (IoT), blockchain with the world of traditional and decentralized finance.

- Automation services are proving fundamental to the success of decentralized finance (DeFi) by stripping away layers of complexity and acting as gateways to DeFi for novice and experienced crypto users.

- The next step in DeFi’s evolution will involve AI and ML.

- AI/ML in DeFi is currently a blue ocean, filled with both – exciting challenges and opportunities.

If one has followed developments in the crypto verse for the past few years, they would have recognized the power of buzzwords. The simple act of adding “blockchain” to the description of a product in 2017 led to a spike in the company’s valuation. Announcing an “ICO” about the same time, enabled pre-seed startups to raise sums previously accessible only to established companies with a track record of continuous delivery.

Some projects went even further by combining buzzwords for maximum impact over an audience affected by a severe case of the FOMO (fear of missing out – ed.n) virus. The irrational exuberance of the ICO craze saw projects combining blockchain with artificial intelligence, machine learning, IoT, Web 3, VR, and AR, fully-capitalizing on the appeal of the Fourth Industrial Revolution narrative. Back in 2017, however, none of these technologies were mature enough to create the disruption some of the founders in the tech space were promising.

Three years later, it may finally be the right time to get excited about buzzword intersections in the tech space.

Yield Hunters

One must have mastered the art of multitasking and adaptation to stay relevant in the blockchain space. It is one of the most dynamic industries of the 21st century. There are projects that launch, attract hundreds of millions in liquidity, and then die in the span of 36 hours.

Yes, the above is a reference to the hottest sub-movement in the blockchain space – decentralized finance (DeFi) and the sub-sub-movement of deGen / MEME projects. Without going into detail about the latter, the most popular activity in DeFi currently is “yield farming”.

Due to composability (AKA interconnectedness), token standardization, self-custody, and the openness of public Ethereum infrastructure, capital is free to move rapidly between DeFi applications with the goal of generating the highest possible yield. It actually looks more like a hunt than farming.

High-ROI opportunities in DeFi are numerous and new ones pop up daily. It is functionally impossible and expensive to follow the changes in varying annualized percentage yields (APYs) offered by dapps. The complexity is increased further by having to consider the possible return of governance tokens, which are usually generated in addition to the APY. Implementing fee optimization strategies on top of all that makes the financially rational use of DeFi protocols a task reserved only to professional traders and smart developers (or the combination of both).

It shouldn’t be a surprise then that DeFi services that obscure the intricacy of DeFi protocol interaction by automating capital reallocation have enjoyed increased interest in the space. One of the best examples here is yearn.finance.

y[ou]earn.finance

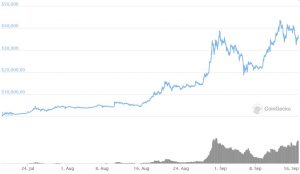

One way to describe Yearn is “a community-driven robo-adviser for yield”. Another is by depicting it as a gateway, or a front door to decentralized finance on Ethereum. The service removes the requirement to stay up to date with all return-generating DeFi products and manually re-allocate tokens when more attractive yields are identified elsewhere. And that’s just one of its uses. Yearn also provides access to insurance, exchange, and complex trading positions either by incorporating third-party protocols or offering its own. Its success is well described by the phenomenal appreciation of its “worthless” governance token – YFI – currently valued at 35k USD, triple the price of bitcoin.

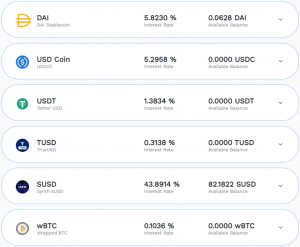

The Earn product by yearn.finance helps users maximize yield on DAI, USDC, USDT, TUSD, sUSD stablecoins, and wBTC. Just deposit cryptofiat in Yearn and it will be automatically moved to the most lucrative sector of the DeFi universe.

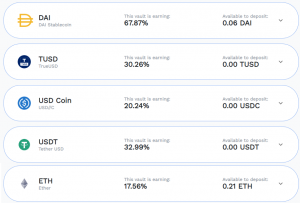

Perhaps the most exciting Yearn product is Vaults. Vaults let users hold an asset they like and earn a yield on it. For example, a hodl-er of ETH can deposit it in a vault and grow it (currently by 17.67% per year).

“Yearn’s robo-adviser that borrows stablecoins against ETH or other crypto assets. The stablecoins are then used to seek yield-farming opportunities, constantly rebalancing as opportunities shift. After gains get realized Yearn converts them back to the underlying token.” CoinDesk

From Robo-Advisers To AI

Yearn has demonstrated that automation services will be fundamental to DeFi’s growth. The most logical next innovation in the space will be the introduction of artificial intelligence (AI).

Considered as one of the most disruptive technologies in traditional banking, AI can enhance the utility of DeFi services by enabling:

Smarter oracles. Oracle services may not only report on the state of the real world (usually the price of asset X) but make short term-predictions regarding it. By looking into market patterns, transactions, and fee data sets, an oracle can warn users about an impending period of high-volatility that could lead to undercollaterization and liquidation.

Network fees optimization. Fees on Ethereum recently reached levels higher than 400 Gwei, leading to users paying hundreds of dollars for interactions with token smart contracts. Unwilling to pay >100 USD, an intelligent AI agent can execute transactions only when it senses a lull in the fee market.

Yield maximization. AIs can implement complex strategies that maximize yield and adapt to the rapidly changing conditions in DeFi. Liquidity relocation could be further automated with more complex approaches applied and modified in real-time based on thousands of data points. This will be beneficial to price discovery, it could dampen volatility, and streamline risk management.

Limit orders. The ability to set a particular price range at which one’s order is executed is still a prerogative of centralized exchanges. Smart contracts managed by AI agents could enable this and more complex functionalities in automated market makers like Uniswap and Paraswap.

User scoring. The banking sector is currently being transformed by AI technology that enables faster and more efficient user risk profiling. Without intruding too much on users’ privacy, the same technology could be applied in dapps in order to enable more sophisticated customer tiers and more advanced incentive mechanisms. At the very least, the user could be able to access higher yields on their liquidity or other exclusive product/service features.

Risk mitigation. AI-manged derivate products being exchanged on blockchain infrastructure is already being explored. The goal is to significantly enhance investment products and onboard liquidity to peer-to-peer financial markets. Improved risk-mitigation is an added benefit.

Automated hedging. The liquidity provision of volatile cryptoassets on decentralized exchanges and portfolio-management dApps frequently leads to impermanent losses. AI can mitigate risks by evaluating them and hedging on other markets accordingly.

Introducing AI in DeFi

Several companies are pursuing the vision of bringing AI and machine learning technology to blockchain/DLT environments. Most are partnerships between companies operating in DeFi and AI.

In November 2019, defi SOLUTIONS joined forces with Zest AI with the goal to make machine learning credit scoring and advanced risk management capabilities more accessible to banks, credit unions, finance companies, and other lenders.

Earlier this month, Level01 technologies and AGDelta signed a partnership to allow artificial intelligence-guided derivatives trading on a DeFi platform.

The Ocean protocol already enables the onboarding of data (tokenization of data) to DeFi protocols by the creation of “datatokens” that grant exclusive access to specific data sets to their owners. Furthermore, datatokens could be used as collateral in stablecoins and loans, effectively tokenizing data.

Subjectively speaking, however, the most interesting project at the intersection of DeFi and AI is Fetch.ai due to its stellar founding team, amount of raised capital, and potentially disruptive impact in a number of industries.

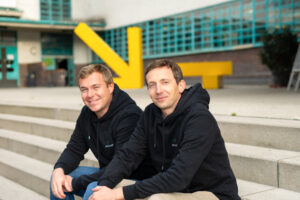

Fetch.AI

Founded by two early researchers and investors in the Google-acquired DeepMind project, Fetch is building an open access, tokenized, decentralized machine learning network to enable smart infrastructure built around a decentralized digital economy. The headquarters of the project is in Cambridge, UK, which streamlines collaboration with some of the most recognized academic institutions.

Fetch’s vision is best expressed by three technological features – Autonomous Economic Agents (AEAs), an Open Economic Framework (OEF), and a smart blockchain-based ledger. The synergy between the three enables a decentralized digital world in which useful economic activity can take place. AI-powered digital entities (representing humans, services, themselves, data, and more), use the OEF to perform tasks involving economic transactions recorded and secured by a scalable blockchain platform.

Fetch technology is aiming to revolutionize data management and processing in Transport, Healthcare, Energy, and (Decentralized) Finance. The project recently launched a derivatives platform – Mettalex – that aims to increase liquidity in the trading of steel, precious metals, lithium, oil, stock indices, and data.

The Fetch.ai blockchain-powered ledger is interconnected with the Ethereum ecosystem (very important!) through the Cosmos protocol, enabling FET token holders to make use of DeFi services on both chains. A new smart contract protocol – Atomix – is expected to launch in Q3 2020 and will enable the tokenization of real-world assets, increasing the liquidity in the DeFi space.

The combination of an ambitious vision, experienced team with a track record of delivery, direct access to vibrant academic, business, user, and developer communities, and a strong focus on DeFi makes Fetch.ai a high-tech project to keep an eye on.*

A blue ocean

Artificial intelligence and machine learning in decentralized finance is a blue ocean. Coupled with the addition of IoT devices that are becoming more and more ubiquitous, the time may be ripe for explosive growth of interconnected, decentralized digital economies. The companies that position themselves and contribute to the creation of these brave new worlds will benefit immensely. This time, however, their users and communities will be winners too.

__________________________

*Fetch’s potential was recognized by two Gartner reports – “Hype Cycle for Blockchain Business, 2019” and “Seize the Technology Advantage With Combinatorial Digital Innovation” – making it only the third blockchain project, after ChainLink and Brave, to be considered by the intelligence company.