Beanstalk: Cryptocurrency project loses $182M after a hacker attack

Not a month goes by without a new report about a major hack in the crypto industry: was it the hack of the crypto game Axie Infinity in March (assets worth $625 million) and Wormhole in February (321 million dollars), the stablecoin protocol Beanstalk is now affected. The Ethereum-based stablecoin protocol has been attacked by cybercriminals, stealing around $182 million worth of crypto assets.

The hack, which took place on Sunday, is one of the largest crypto hack attacks that has happened in the crypto industry so far. The circumstances that led to the event are currently being investigated.

“We’re engaging all efforts to try to move forward. As a decentralized project, we are asking the DeFi community and experts in chain analytics to help us limit the exploiter’s ability to withdraw funds via CEXes. If the exploiter is open to a discussion, we are as well,” shares the Beanstalk team.

As is known from the recent past (e.g. Iron Finance. Libra/Diem), stablecoin projects are very difficult to implement and are prone to errors. BEAN is no different, the stablecoin lost its dollar peg in minutes and imploded.

Token sales should be prevented

24,830 ETH and 36 million BEAN tokens were stolen – now the aim is to prevent the thieves from exchanging the crypto tokens for other tokens or fiat via exchanges. Sometimes the attackers and the operators can agree that parts of the assets are returned. According to the security company Peckshield, which specializes in blockchain and which repeatedly uncovers crypto hacks, the attackers were able to secure crypto assets worth $80 million. the remaining around $100 million are said to be paid as transaction fees to DeFi protocols or decentralized exchanges such as Uniswap, Aave, or SushiSwap.

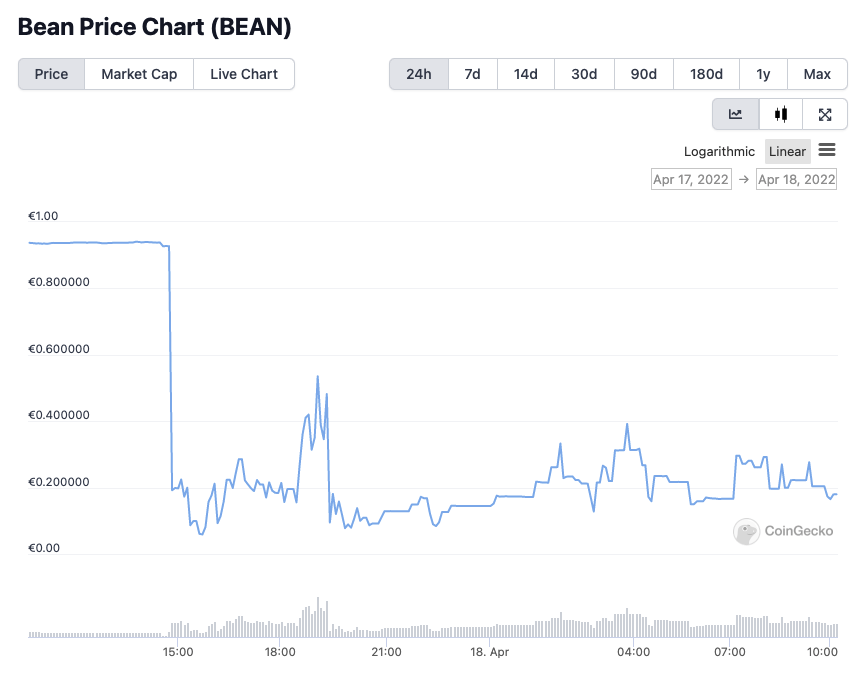

The technical background for the vulnerability, which the attackers were able to exploit, has already been documented here. As data from CoinGecko shows, the BEAN stablecoin collapsed as a result of the attack and lost around 80% of its value – and thus nothing to do with the promise of a stablecoin.

The biggest crypto hacks in recent years:

| Service | Stolen Assets in M$ at time of the hack | Stolen Assets | Type | Date |

| Axie Infinity (Ronin Network) | 625 | 173.600 ETH, 25,5 Mio. USD | Blockchain Game | March 2022 |

| Poly Network | 611 | ETH, MATIC, etc. | Cross-Chain | August 2021 |

| Coincheck | 534 | NEM | Exchange | January 2018 |

| Mt. Gox | 460 | 744.408 BTC | Exchange | 2011 |

| Wormhole | 321 | 120.000 wETH | Token Bridge | Februar 2022 |

| KuCoin | 285 | BTC, ETH, ERC-20 | Exchange | September 2020 |

| Bitmart | 200 | BNB, SHIBA INU, etc. | Exchange | December 2021 |

| PancakeBunny | 200 | BNB, BUNNY | DeFi Protocol | May 2021 |

| Beanstalk | 182 | 24.830 ETH, 36M BEAN | Stablecoin Protocol | April 2022 |

| BitGrail | 170 | NANO | Exchange | 2018 |

| Vulcan Forged | 140 | PYR | Blockchain Game | December 2021 |

| Cream Finance | 130 | ETH, wBTC, USDT, USDC, etc. | DeFi Protocol | October 2021 |

| BadgerDAO | 120 | 2.100 BTC, 151 ETH | DeFi Protocol | December 2021 |