Bitcoin makes history: Why BTC hit $100,000 on December 5th

On the night of Thursday, December 5th, at around 3:40 a.m., the time had come: Bitcoin made history by crossing the $100,000 mark. It took 15 years since the first block of by far the most important blockchain in the world was written for this historic mark to be reached. In total, all of the Bitcoins that have been produced so far – around 19.79 million – are worth more than $2 trillion.

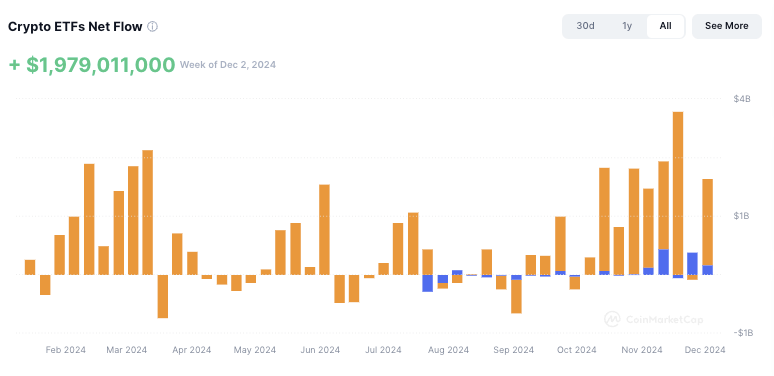

Bitcoin has made strong gains in 2024, after a crypto winter, for several reasons. Most of them have to do with the USA. At the beginning of 2024, Bitcoin Spot ETFs were approved on Wall Street, and since then they have enabled BlackRock, Fidelity and other financial giants to make it easier for their investors to invest in digital gold. Since its launch in February 2024, tens of billions have flowed into these exchange-traded funds.

Trump brings in crypto-friendly SEC chief

The new all-time high of $103,900 on the morning of December 5th also has a lot to do with the USA. Since the re-election of Donald Trump, who positioned himself as the next crypto president in the election campaign, cryptocurrencies have been moving from one record to the next – it is a bull market again. Trump stands for an expected friendly crypto policy and is directly advised by numerous crypto-friendly entrepreneurs, most notably Elon Musk.

In addition, there is a personnel decision that was made on Thursday night that has further boosted the price of Bitcoin and other crypto assets. Trump has nominated Paul Atkins for the position of the important SEC chief. The next chairman of the US securities regulator SEC will therefore be someone who, among other things, was previously co-chair of the Token Alliance, a lobby group for crypto assets at the Digital Chamber of Commerce. He will replace the crypto-critical Gary Gensler, who was appointed by Joe Biden and who has waged war against the crypto industry in recent years with SEC lawsuits against Coinbase, Kraken, Binance, and Co.

TRON: New record value for TRX token between bananas and Trump

Bitcoin – the virtual gold

A second powerful US official has also spoken out about Bitcoin. Jerome Powell, chairman of the US Federal Reserve (FED), said on Wednesday at the New York Times DealBook Summit in Manhattan that he sees Bitcoin as digital gold. “It’s like gold, only virtual... It’s very volatile, it’s not a competitor for the dollar, it’s really a competitor for gold. That’s how I see it,” said Powell. This also contributes to BTC continuing to flourish.

Because, as Bitcoiners like to calculate, the effects of the Bitcoin halving will not really take effect until 2025. The halving ensures that the amount of new BTC being mined is halved every four years. This means that potentially constant or higher demand meets less supply, which in theory drives up prices. But since Bitcoin is now widely used – for example in the ETFs mentioned on Wall Street – it is exposed to macroeconomic effects and geopolitical events in a similar way to tech stocks.

The crypto industry has long been assuming that 2025 will be a strong year for crypto. Further interest rate cuts are to be expected in the US and the EU, which are usually good for riskier assets such as Bitcoin or tech stocks, and the EU is introducing the MiCA crypto regulation. And since Trump will come to power in January with a host of crypto supporters in his wake, many are currently expecting a very strong bull year in 2025. Result: Bitcoin will break the $100,000 mark on December 5th.

The Altcoin Season has officially begun – what does it bring?