Dark times and another accusation for Ex-Unicorn GoStudent

The accusations surrounding the former Viennese unicorn “GoStudent” continue. Just about a month ago, the Austrian startup basically lost its unicorn status after the lead investor Prosus commented that the current value of the company had decreased from €3 billion to about €970 million. But… the bad news for GoStudent continues with even more serious legal questions.

After a few signals for irregularities between GoStudent and the tutors, we decided to look into it. In this article, we comment on what we found out about the relations between the company and the tutors.

Trending Topics spoke to eight tutors from Germany who wish to remain anonymous. Five of them are still active as teachers on the tutoring platform, two have “had enough” and have since separated from the company, and one person is in the process of separating “piece by piece”. All accuse GoStudent of changing their terms and conditions without informing them, rewriting invoices retrospectively, and suddenly demanding that tutors pay taxes via the so-called reverse charge system – from the commission that GoStudent collects for its placement services. The company denies all allegations and does not comment on the subsequently adjusted invoices.

The business model and quality assurance at GoStudent have already been criticized several times. Back in 2021, the German Teachers’ Association had to intervene in order to protect the students. Later on, reports emerged that the sales team had used “psychological games” to put both tutors and customers under pressure.

In 2022 the GoStudent platform was involved in another major scandal, where it was reported that a 15-year-old was forced by an adult tutor to send explicit images.

And just about a month ago, after another investigative piece by Trending Topics, it became clear that GoStudent is behind the “independent and transparent comparison platform” for tutoring Nachhilfe.de. Not only was the portal not transparent, but it also did not represent any other providers but GoStudent.

GoStudent loses unicorn status after devaluation by lead investor

Issue 1: Something is fishy with the contracts

According to the GoStudent terms and conditions, “a teaching contract is concluded between the teacher and the user when the teacher accepts a request for video lessons.” This means that the contract is concluded directly between the tutors and the parents.

However, such a document seems to not exist at all, the tutors told Trending Topics. Especially considering that the two parties are not allowed to contact each other. The terms and conditions of GoStudent state: “The teacher contract is concluded individually by telephone or by comparable electronic contact.” By this, GoStudent means itself, as the company calls the parents or customers and tries to sell them a tutoring subscription. “The contract can also be concluded online on the platform by clicking on the button “Order now for a fee,” the terms and conditions read. GoStudent therefore concludes the teacher contracts for the tutors.

Payment is also processed via GoStudent – not between the tutor and the parents. Parents are not sent an official confirmation of the conclusion of the contract. They can only find a document in the GoStudent login area that records the “official agreement” for the tutoring. Tutors working on the platform are not allowed to view the document, citing data protection as the reason. Therefore, the tutors have no clue what GoStudent is actually charging the parents. And vice-versa. Parents are also not informed how much of what they pay goes to GoStudent.

Trending Topics has a copy of such a contract for a 12-month tutoring agreement from Germany. Although there is an oral and written contract between the parents and GoStudent, the terms and conditions state: “GoStudent itself is not a party to the teacher contracts concluded between the users and teachers.”

However, in the chat logs between GoStudent employees who are responsible for tutors and the tutors themselves, it is repeatedly mentioned that there are indeed contracts between the GoStudents and the parents.

Issue 2: The changing GoGuidelines

There is also a document, the “Go Guidelines – Contractual Principles“, which GoStudent had the tutors sign. Trending Topics has a handwritten version dated July 13, 2019. By the end of 2022, the tutors had to digitally agree to the “GoGuidelines”, as the documents show.

GoStudent only wants to be an intermediary and writes in its terms and conditions that “No employment relationship of any kind arises between the teachers and GoStudent”. This claim seems to bother many of the tutors, among them the eight “self-employed” tutors with whom Trending Topics spoke. Despite being “self-employed”, tutors are given strict guidelines on how to work.

Tutors are “recommended” on which days and at what times they should teach, they are “encouraged” to give at least six units per week of tutoring and even “must” ensure that they are handed over to another tutor before leaving the platform. All of this can be read in the guidelines, which tutor Amalia* agreed to digitally at the end of 2022. Other regulations are written down in the terms and conditions, but these are constantly updated – according to the eight tutors, without them ever being informed about it.

The fact is, GoStudent has agreements with both parties, gets paid by parents for its services, pays the tutors a portion of it, but still describes itself as only an intermediary.

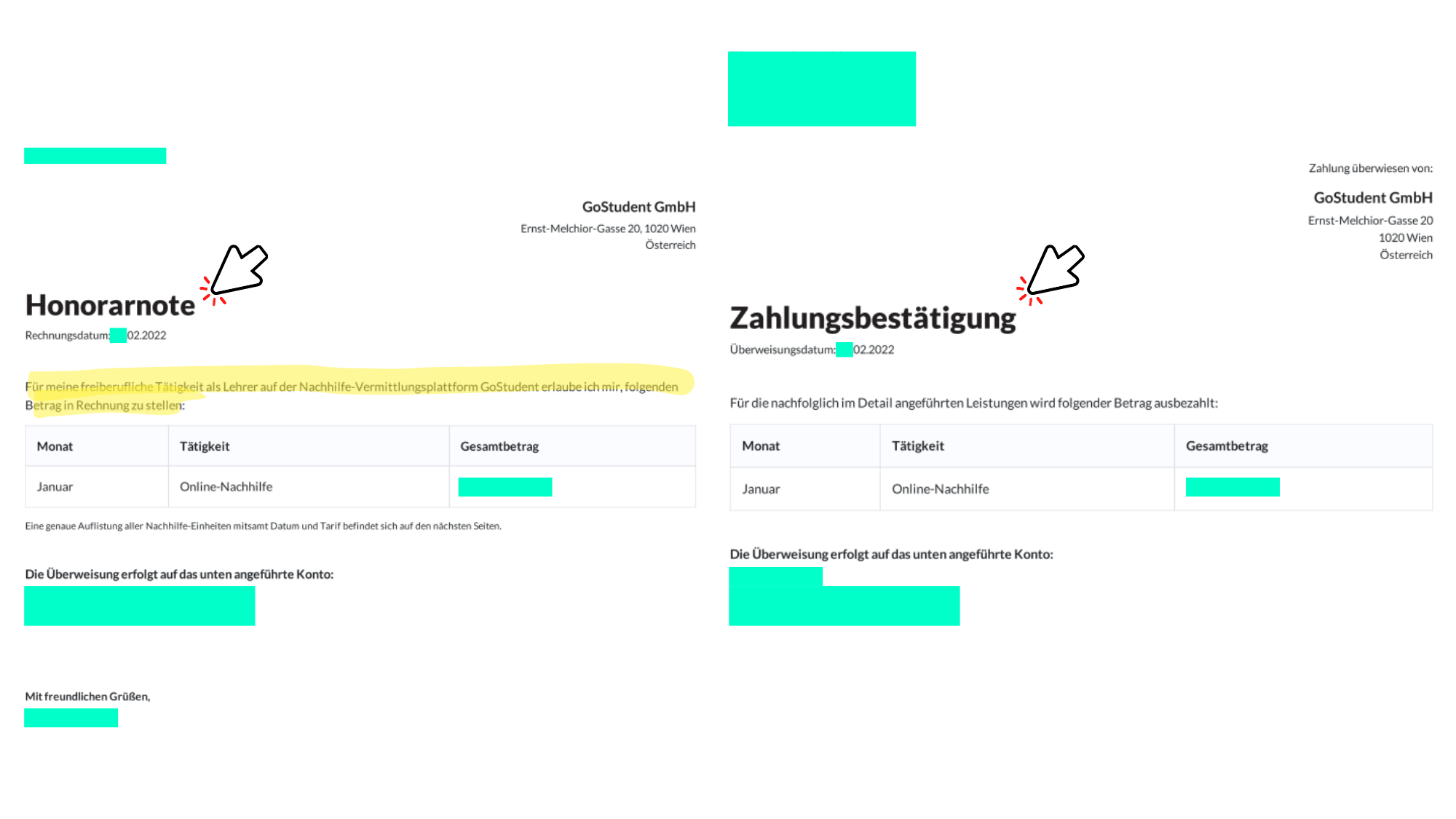

Issue 3: How fee notes magically turn into payment confirmations

When it comes to payments and invoices, the story gets even more exciting. Originally, tutors were issued “fee notes” (a kind of invoice) for their tutoring services – automatically generated by the GoStudent system. These showed the amount that GoStudent transferred to the teachers – taxes were not mentioned.

The same fee notes were later renamed “payment confirmations”, but took the same date, and the sentence “For my freelance work as a teacher on the GoStudent tutoring platform, I take the liberty of charging the following amount.” was deleted. Trending Topics also has some copies of these that clearly show that invoices were subsequently changed. In their own words, the tutors have found out about this by chance via a section in their respective tutor profiles on the GoStudent platform.

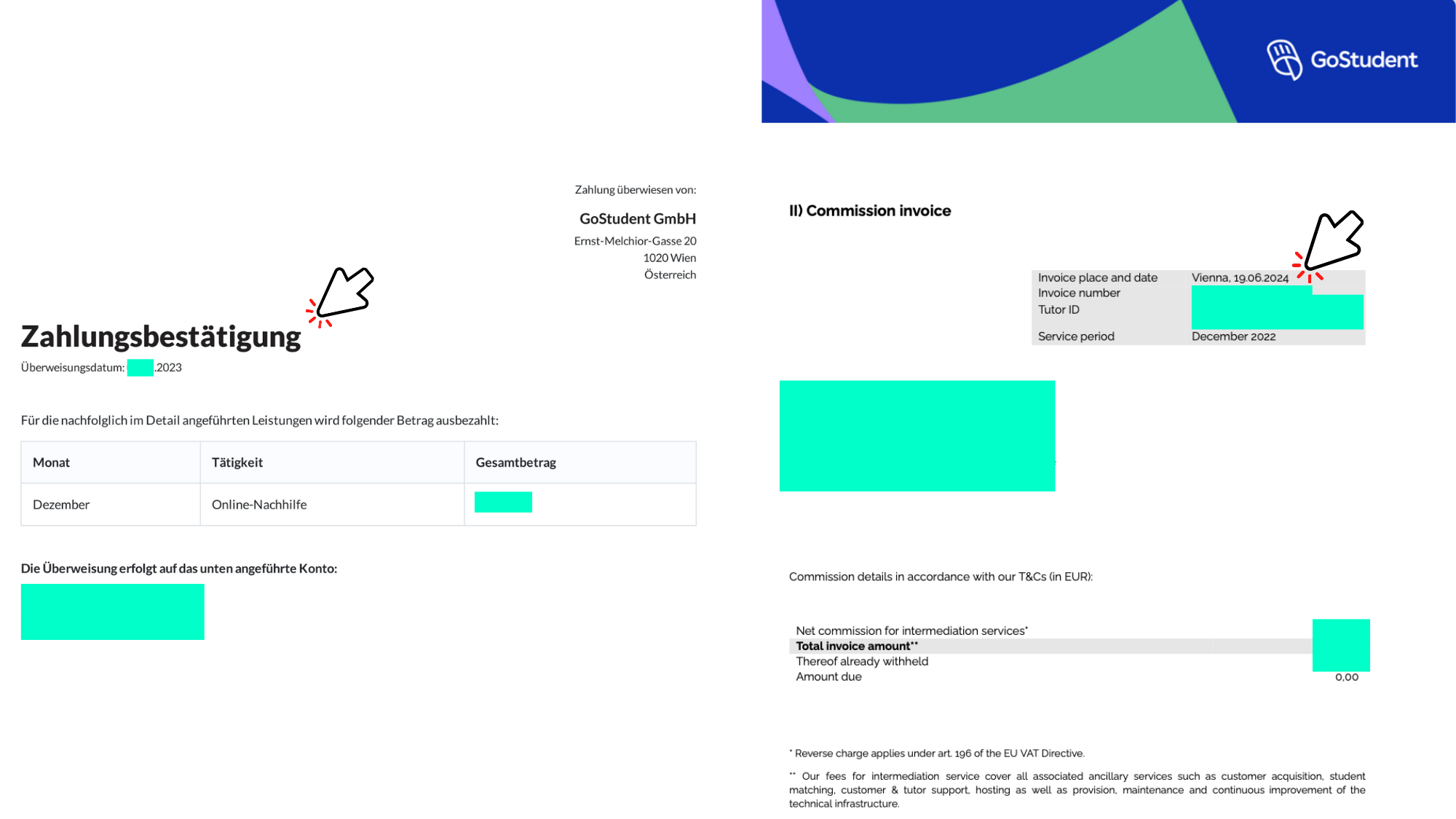

Issue 4: A third type of “invoice” appears

But that’s not all: Since at least December 2022, a third type of invoice has been issued with an old date, which now mentions taxes and a GoStudent commission. Another name change has taken place: “Payment confirmations” were subsequently changed to “Information about tutor payment and invoice for placement services” – again they take the same date.

According to the tutors interviewed, no invoices at all were issued by GoStudent for numerous months – to this day they are waiting in vain for invoices. According to a German insider, “invoices from before June 2023 have to be created manually,” as he knows from a GoStudent employee. That is why the issuing process takes so long. Trending Topics has a screenshot. “The invoices change practically constantly, just like the terms and conditions,” says tutor *Ibrahim.

Issue 5: A game with commissions and taxes

Who actually pays taxes here? Good question. Our attention is focused on the third type of receipt, the “colorful invoice,” because it has a colorful pattern, unlike its two previous ones. It is the most detailed of all the documents issued. It lists two new points, namely, the net commission for placement services and the reverse charge system.

Now it gets tax-heavy, because this clause, which tutors “accidentally” discovered on their invoices in 2023, states that tutors have to pay taxes on the commission that GoStudent collects. In the case of Matthias L.*, that meant paying taxes for about €1.000 for June last year. The tutors “suddenly feel like they are being treated like customers” – they assumed that their tutoring services were tax-exempt, as regulated in the Sales Tax Act (UStG) in Section 4 No. 21 UStG.

GoStudent sees it differently. The company requires tutors to pay sales tax through the reverse charge procedure for “customer acquisition, student matching, customer & tutor support, hosting and provision, ongoing operation and continuous development of the technical infrastructure” – for their placement services. So tutors do not have to pay taxes for the tutoring service itself, but they do have to pay taxes for everything else.

GoStudent: Free service until it is not

Another thing to spark curiosity is the “GoGuidelines” that Amalia* accepted at the end of 2022 when joining GoStudent as a tutor. The GoGuidelines state the following: “GoStudent provides the infrastructure and the placement of students free of charge”. She accepted this and agreed to it.

According to her own statements, she neither agreed to nor was informed about the reverse charge system, whereby “self-employed” tutors are supposed to pay taxes on GoStudent’s commission with an old day. Let’s remember: According to the tutors, the colorful invoices have only appeared since the middle of 2024 – some of them issued retroactively until at least December 2022. Previously, fee notes or proof of earnings were issued and the income was stated net without taxes. When asked by Trending Topics, GoStudent did not comment on whether or for what the company pays taxes.

Tutors are unsure how to handle tax issue

In simple words, due to the reverse charge system, tutors might have to pay taxes for the previous years they have worked with GoStudent. Of course, this might also cause serious problems with the German tax office.

“When asked, they said that this procedure had been in place since 2022 and that the tutors should have asked for invoices. I should also add that I was told at the beginning that I would be working freelance on commission. By doing this, GoStudent has turned us all into tax evaders,” tutor Max* told us.

If the procedure has actually been used since 2022, the question remains why the tutors were not issued the “colorful invoices” directly? Why were they sent fee notes and proof of payment first and in some cases the colorful invoice, i.e. the “information about tutor payment and invoice for placement services”, was only issued one and a half years retroactively? GoStudent did not respond to the question of why the invoices were subsequently adapted at least until December 2022.

Amalia* sums up the situation like this: “The whole thing is very stressful for me and I’m not the only one. Most of the people here, including me, are young people, some of them still students, who cannot afford a tax advisor or lawyer. GoStudent lured us with ‘quick and easy’, but now we suddenly find out that we may owe more than two months’ salary in taxes? That causes existential concerns. I love my work as a tutor, but the current situation makes me doubt whether I may have made a serious mistake in 2022 when I started at GoStudent.”

GoStudent denies allegations

Trending Topics confronted GoStudent with the allegations and gave the company a week to respond. GoStudent denies that there is anything amiss here. “Any suggestion that we pass taxes on to tutors is false,” a company spokesperson responded by email. She went on to say: “As a platform that connects tutors with students, GoStudent is not responsible for and cannot assume the taxes of individual tutors who use the platform. All tutors on the platform are self-employed and therefore responsible for declaring and paying any taxes due in accordance with their individual circumstances.” She concluded by adding that GoStudent will review its “tutor guides to help tutors better understand potential tax aspects of their work.”

Only the courts can decide

Last year, GoStudent was convicted by both the Vienna Higher Regional Court and the Cologne Regional Court for numerous inadmissible clauses. These included clauses on unilateral changes to the general terms and conditions and services, to name just one example.

The general terms and conditions currently state: “Any taxes and duties associated with the payment of the credit must be declared and paid exclusively by the teacher. The teacher undertakes to hold GoStudent harmless in this regard.” Tutor Jan* concludes: “Many tutors now simply evade taxes out of ignorance and hope for the best.”

*All tutor names have been changed to protect the sources.