How Decentralized Finance Protocols Fared During One Of The Worst Weeks For Global Finance

In short:

- A liquidity crisis gripped global markets last week, trimming billions of stocks, commodities, and cryptocurrencies.

- 2.2B USD worth of long BTC positions were closed leading to sharp price declines in all cryptocurrencies.

- The price of ETH followed general crypto-market trends and lost 50% of its value, leading to mass loan undercollateralization in Maker.

- Ethereum got congested and gas fees skyrocketed, disrupting network usage and DeFi protocols.

- The DeFi industry was reminded of the possible negative consequences of low Ethereum scalability. Used wisely, that information could make the ecosystem more resilient in the future.

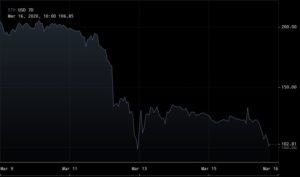

On March 12, 2020, following a week of depreciating global stocks, the price of ETH, the second most popular cryptocurrency, plummeted by 30% from 195 USD to 135 USD.

The sudden loss of value was instigated by the automatic liquidations on several crypto exchanges, offering margin trading. In total, $2.22B worth of long positions (mainly BTC) were closed, the majority of them being on BitMex, OKEX, and Huobi.

The rapid ETH price decrease led to panic and further selloff, pushing the price down to $100. Such sharp price moves in either direction test the scalability limits of public blockchain platforms. This time was no exception. Gas fees on Ethereum saw a tenfold increase, causing network-wide disruptions.

The combination of sharply falling ETH price and network congestion created the perfect storm for all applications on the public Ethereum blockchain, including Decentralized Finance apps.

ETH Price Collapse – Mass Loan Liquidations in Maker

One of the most useful services that Decentralized Finance offers to its users is the ability to use volatile cryptocurrencies as collateral for loans in stablecoins. The first project to offer such a functionality was Maker. Using the Oasis app, users can lock their ETH or BAT tokens and generate DAI, a decentralized stablecoin soft-pegged to 1 USD. The app serves as a non-custodial virtual bank that takes users’ collateral in ETH/BAT, mints new DAI, and sends it to the users. This service is not offered for free. When a user wants to get the ETH/BAT back, they must pay back the amount of DAI they borrowed plus the accrued interest (currently 0.5% per year).

Since cryptocurrency prices have proven to be highly unstable, DAI loans are overcollateralized, meaning that the value of the loan is much lower than the value of the locked collateral. Maker has determined that a minimum 150% collateralization is required for the system to function properly. 100 USD in ETH can only generate 50 DAI.

Since its launch in 2017, DAI has become the most widely used stablecoin in DeFi, while Maker’s smart contracts that secure the ETH/BAT collateral store more than 53% of all the value in the space.

Declines in the price of ETH usually result in some DAI loans reaching the point of liquidation. When that happens, the user must either add more ETH as collateral to push the collateralization rate at or above 150% or pay back their loan by returning DAI and paying interest. If they fail to do so – liquidators can pay off the user’s debt and get the locked ETH at a 3% discount (max).

ETH’s sudden plunge was expected to result in mass loan liquidations in Maker. Surprisingly, that did not happen immediately, leading us to the next major disruption

Consequences Of Skyrocketing Gas Fees in Ethereum

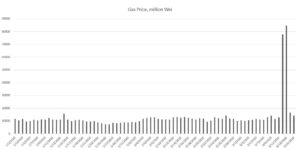

One of the few values that went up on Black Thursday was the price of gas in Ethereum. Using public blockchain infrastructure is not free. All transaction initiations or smart contract executions cost an amount of gas denominated in ETH. On March 12, the price of gas went up almost 900%.

Maker’s ETH/USD Oracle Capitulation

Apart from the high collateralization requirement, to function properly, Maker’s decentralized protocol must be kept up-to-date about the price of ETH/USD (and BAT/USD, but BAT tokens are much less popular as collateral type). That information is essential so that the protocol can quickly detect and settle loans that are becoming undercollateralized, meaning that the value of their collateral is falling below the required 150%. That is done through an on-chain price feed known as “oracle” or the “MCD-Medianizer”.

The sudden and sharp increase in gas cost prevented Maker’s price feed oracle from providing the most current price for ETH/USD. The cause is still being investigated, but the most probable reason is that other participants outbid the on-chain oracle transaction delivering price information to Maker’s smart contracts. There were simply other applications and users that were willing to pay a higher gas fee to have their transactions verified as soon as possible. Imagine thousands of users worldwide scrambling to send their ETH to exchanges.

The failure of Maker’s oracle led to the protocol losing connection with market reality.

Source – Twitter

The MCD-Medianizer stopped reporting the most recent, much lower ETH price for a few hours. Once the oracle recuperated, it became evident that hundreds of DAI loans are now undercollateralized and must be closed.

Loan liquidations in Maker are performed by self-interested third parties (usually scripts/bots) looking to make a profit. Due to network congestion and the fact that most of them were not programmed to pay network fees north of 20 USD, most liquidators did not react. Since liquidators bid on the amount of DAI they are willing to pay to receive the ETH/BAT collateral, and there were no active bids, the few remaining liquidators discovered a profitable system exploit.

Liquidators were able to bid 0 DAI and win lots of up to 50 ETH (~5000 USD).

Out of 3994 liquidation transactions, 1462 (36.6%) were realized with 100% discount. That had a few important effects:

- A small number of liquidators who managed to apply the “0 bid strategy” made fortunes in a matter of hours, although they had to pay higher network fees.

- DAI borrowers (AKA Vault Owners) lost 100% of their collateral, which is not supposed to happen.

- The Maker system became undercapitalized by 5.67m USD, meaning that there was (and still is) more DAI than ETH/BAT collateral backing it.

One user who lost 100% of their ETH went as far as to threaten to contact the US Federal authorities concerning the incident.

Maker’s Community Reaction?

Unsurprisingly, following the incident, Maker’s Forum was flooded with comments. Shortly after, a post was published in Maker’s blog outlining the actions to be taken. An Executive vote was held on March 13 and passed on March 15. As a result, several parameters of the Maker system were adjusted on March 16, affecting DAI’s monetary policy, governance, and liquidation process.

To address the 5.67m USD undercapitalization problem, new MKR tokens (used for community governance) will be minted and sold off for DAI following Maker’s whitepaper Risk Mitigation strategy. To achieve that, an auction is scheduled to take place on March 19, where MKR tokens will be auctioned off in lots for 50,000 DAI.

It remains unclear if users that got 100% liquidated will be compensated.

While undercapitalization of the system was envisioned, a full loss of user collateral has not. As a result, the project lost hard-earned users’ trust, essential for any blockchain-based project, especially in the young DeFi space.

The situation can get worse if regulators, prompted by unhappy users, develop an interest in Maker. So far, Maker’s community has acted swiftly and adequately to protect the system. It remains to be seen if they are willing to go as far as to bail out individual users and what will happen if they decide not to.

More Consequences Resulting From the Ethereum Gas Price Hike

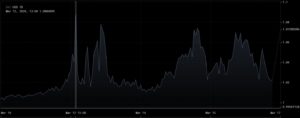

The Price of DAI Reached 1.09 USD For The First Time, Breaking Its USD Peg

On the background of the loan liquidation panic, users scrambled to acquire DAI and repay their loans before liquidation.

The excessive demand for DAI resulted in its price breaking the 1 USD soft peg and reaching almost 1.09 USD on the centralized crypto exchange Kraken.

The DAI liquidity crunches that started on March 12 (see the chart above) resulted in another Emergency Vote (held on March 16) and led to the inclusion of Conbase’s centralized stablecoin – USDC – as the third collateral type in Maker (now, ETH, BAT, and USDC). The hope is that users will be willing to create DAI loans using USDC as collateral, bringing more DAI into circulation, and pushing DAI’s price closer to its 1 USD target. With a very high borrow interest rate of 20% per year, it is unclear if the hopes of the Maker community will materialize.

+++ Learn more about the USDC’s risk parameters in Maker’s blog +++

ChainLink’s ETH/USD Oracle Was Also Disrupted

ChainLink is a DeFi project offering tamper-proof data feeds for complex smart contracts on any blockchain. Several of the most popular DeFi projects use ChainLink’s data oracles to keep their protocols updated with the latest asset prices. Synthetix, Aave, bZx, Nexus Mutual, and Set Protocol are all ChainLink’s clients.

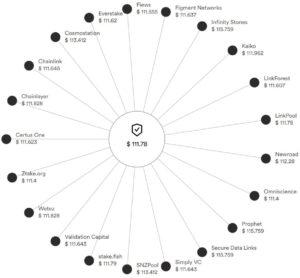

ChainLink’s ETH/USD price feed, one of the most popular ones in the DeFi space, is derived by the price reports of 24 node operators (validators). The price reports are delivered via on-chain transactions.

According to Twitter user BAND Jedi Master, during March 12’s gas fee price hike on Ethereum, faced with excessive network fees, ChainLink’s validators stopped delivering reports for six hours. That made ChainLink’s ETH/USD oracle useless and exposed all DeFi projects using the feed to potential manipulations.

So far, ChainLink hasn’t provided any comments on BAND Jedi Master’s claims of oracle failure, and no projects have reported issues caused by ChainLink’s oracle disruption.

Nonetheless, even if the disaster was averted this time (possibly by sheer luck), ChainLink’s oracle feeds are becoming a single point of failure in the DeFi space. They must receive special attention from the community.

dYdX Increased the Minimum Trade Size

As a response to increased gas fees dYdX, a decentralized exchange for crypto assets increased the minimum value of a single trade to a high of 40 ETH / 5000 DAI on March 13. That made the platform unusable for small-value traders for most of the day.

Source – Twitter

The move was prompted by the increased operational costs that dYdX had to incur since the protocol has been subsidizing transaction fees for all trades since September 2019. In February 2020 alone, the platform had to pay 40k USD in gas fees due to increased trade volume. Single trade sizes were returned to later in the day on March 13.

Argent Users Experienced Failed Transactions

Much like dYdX, Argent, a secure Ethereum wallet, decided to save users the nuisance of having to pay network fees and opted to pay for gas themselves.

On March 12, the clogged Ethereum network caused the transactions of some Argent wallet users to fail, even though the DeFi project always pays the highest possible network fee (“fast” gas price). Furthermore, when a transaction is stuck, the Argent protocol automatically reinitiates it with a higher fee to ensure that it goes through. When that happens, however, the transaction hash changes.

Due to a front-end issue with the Argent mobile app, that hash change was not reflected, confusing users about the status of their transactions.

Since the incident occurred, Argent published a detailed blog post explaining the cause of the issues and how they are being addressed. In the future, if users want to initiate super-fast transfers or there is network congestion, they will be able to pay for the high gas fee themselves.

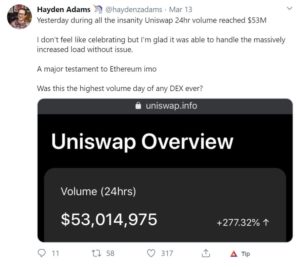

On the Positive Side – Volumes on Decentralized Exchanges Rose

One of the more constructive effects of Black Thursday’s panic was the increased volume on decentralized exchanges and other DeFi apps.

Source – Twitter

Here is some more data from dappradar.com:

- Liquidity protocol Kyber Network – 1,543 unique active wallets, up 70%

- Decentralized trading dapp dYdX – 569 unique active wallets, up 133%

- Decentralized exchange 1inch – 491 unique active wallets, up 77%

- Decentralized exchange Uniswap experienced its second busiest day ever with 1,693 unique active wallets (up 33%)

- DeFi lending app Compound hit a 2020 high of 560 daily unique active wallets (up 90%)

DeFi Projects Follow Stock Market Trends and Remain Highly Volatile

The ETH price collapse on March 12 served as a reality check for all projects developing apps on Ethereum and using ETH (or any other cryptocurrency) as collateral. It once again proved that Ethereum needs a scalability upgrade before it could become the global settlement layer for billions of financially [underserved] users.

Looking at the DeFi space, apart from Maker’s serious undercapitalization issue, no other project faced significant losses. Disrupted access to services was the predominant issue throughout the space, but periods of degraded performance are not uncommon even for centralized projects in the crypto industry.

The market capitalization of all DeFi projects was indeed reduced, but so has almost every other liquid asset, including gold. Generally, the DeFi space did not learn anything new – ETH is volatile, Ethereum is [currently] not scalable, oracles are single points of failure, and software bugs cause loss of trust and value.

DeFi was battle-tested last week. It came out slightly bruised but all the wiser.

More from the same author:

An Introduction to Decentralized Finance: Blockchain’s new killer use case