The Digital & Startup Ecosystem Trends In Bulgaria: Possible Emergence Of A New Deep Tech Wave And Focus On Solutions For Social Welfare

The Bulgarian digital and innovation ecosystem continues specializing in platform building and technologies related to big data analytics, machine learning, and automation, which could be identified as a sign of emerging deep tech competence. The tech companies offer their solutions mostly to other tech businesses or the financial sector. Interestingly enough, and for the first time, a new trend is becoming evident – ventures providing solutions for social welfare are on the rise. This shows the fourth edition of the only study of the digital and innovative business in Bulgaria – InnovationShip 2019, in which 233 companies were surveyed.

“Bulgarian startups carry the technological capacity and topical engagement to drive the change of the economic portrait of Bulgaria and to position it as one of the key hubs for innovation in Europe and the world,” comments Sasha Bezuhanova, founder of the think tank MOVE.BG, that stands behind the study.

Bulgaria and deep tech

Yet contrary to a report released earlier this year by Dealroom stating that Bulgaria is the new deep tech hearth of Central and Eastern Europe, the results of this new research are arguing that “there are first trends of a possible emergence of a new wave of deep tech startups.” Still, companies developing technologies in areas such as information security, biometry, geolocation, and VR, which are an essential part of the deep tech domain, are rather rare, explains Anton Gerunov from The Center for Modeling Socioeconomic Systems to the Sofia University “St. Kliment Ohridski”, who led the research.

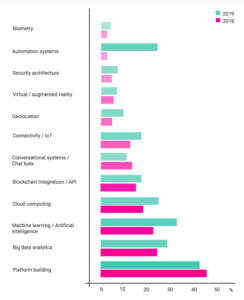

The overview of the companies’ specialization and preferred technologies used both in the 2018 and 2019 InnovationShip survey indicate that although there is still a high interest in the leading categories, some types of specialization have become increasingly popular. Companies are mostly involved in platform building (42%), big data analytics (28%), machine learning and AI (32%), cloud computing (25%) and since 2019 – automation systems (25%). Less attention is received by offerings in virtual reality and information security. The least number of companies are interested in offerings in the field of biometry, which is highly specialized and requires expert knowledge in numerous areas – biometry has seen a slight decrease since last year, which shows that seemingly the Bulgarian market in the field follows the global trends with certain lags, reads the report.

“The core of deep tech is more the technology itself rather than the business model, and the development of such technologies requires a lot of time,” states Georgi Kadrev, co-founder of Imagga, an 11-years-old company specialized in image recognition algorithms. According to him, even though the tech ecosystem in Bulgaria has matured a lot over the past five years, there’s still a way to go.

“To develop competences and expertise in deep tech and cutting-edge technologies Bulgaria needs large R&D centers and significant infrastructure. It’s not enough to have a bunch of small companies struggling to develop such technologies. The ecosystem needs to start leveraging what is already given – the new supercomputer in Sofia Tech Park, and funding programs like Horizon2020,” Todor Kolev, the co-founder of Comrade Cooperative, comments on the presented data.

Not least, the development of such technologies requires capital. Indeed 36% of the companies report that access to funding has been among their challenges in the past year. One possible reason is the delay in the closing of some of the expected in 2019 funds focused in these areas, for instance, VCs like New Vision.

An emerging focus on social welfare

A 2019 edition of the report also shows another trend – the growing number of tech and digital companies developing solutions to societal challenges. While the majority of the surveyed companies still sell to the financial sector (with Bulgaria being the CEE county with the highest number of fintech companies), and other IT companies, in the top ten of the sectors where small and young ventures focus we find also education, healthcare, and culture.

One-third of the micro, small and medium digital businesses focus on offering their solutions to the tech industry, and 24% focus on the financial sector. The third most popular industry to focus on is surprisingly education with 22% of companies reporting it as a primary target.

The profile of the tech and digital ecosystem in Bulgaria

Aside from the two potentially interesting trends outlined by the report, the development of the ecosystem in terms of market orientation, financial performance, and preferred business models hasn’t changed much since last year. The focus of the Bulgarian ecosystem is still on services – rather few of the companies offer solely a product (21%), the vast majority either combine both product and service (47%) or have focused exclusively on providing a service (32%). The incomes generated by digital and tech micro, small and medium companies are still rather modest.

Almost one-third of the participants are companies in the sample founded in 2018 and 2019 and half of them have still not registered any revenues. Of the overall sample, about a quarter had no revenue in their time of existence. A major segment of surveyed companies – 27% have annual revenue of fewer than 25 000 euros, which serves as evidence for a large number of newcomers in the digital ecosystem and hints at the growing interest for entrepreneurship in the field. Only 14% of the companies have a revenue of 51-150 thousand euros and another 14% are ventures that make 151-500 thousand euros. The companies that have managed to pass the 1 Million thresholds are 10% of the respondents. 2% of companies report revenue of more than 10 million euros, which is about four times more than they were in the previous year. The results also show that 54% of the companies have a positive cash flow which is somewhat.

In terms of market orientation, Europe and the region are still the main targets with 65% of the respondents currently selling in these markets. Interestingly, there has been a withdrawal from the national market – compared to the 81% of companies that operated on the Bulgarian market, this year they are 74%. The results show that two-thirds of the companies that do sell on foreign markets have them as a primary revenue source.

What does the local ecosystem need to speed up

Although the ecosystem is developing, there are some challenges that need to be overcome in order to accelerate that process, suggests the report. Around a third of the companies identify the lack of funding as their main concern. “Although both Bulgarian and international investors seem to be interested in the startup stage, funds are still insufficient. There’s not enough funding for pre-seed stage companies,” says Sasha Bezuhanova. Yet, on a more positive note, a new fund in this segment – Innovation Accelerator – is starting operations right now. The lack of talent is another traditionally appearing in such reports challenge, with a bit under 40% naming it as an obstacle.

A good 43% of the participants in 2019 declare that they would benefit from better e-government. The establishment of a legal framework for companies in the digital ecosystem is a top priority for 52% of companies. The promotion of investment in startups through preferential tax treatments in order to attract investors and business angels has progressively been gaining importance and is now a priority for 45% of companies.

“It’s a good sign of maturity that the digital business already has particular requirements and expectations that can be discussed with the state,” said Martin Danovsky, Chairman of the Managing Board of The governmental Fund of Funds. He also emphasized on the work that the Bulgarian startup association (BESCO) is doing is crucial and that representatives of 12 ministries and institutions are already working on improving and adjusting the legislation to the digital business in the country. How long will this take, however, and whether the measures will be adequate to the ecosystem, remains to be seen.