Eleven Capital Is Now Officially A Public Company. What Does It Actually Mean For The Ecosystem?

“The listing of Eleven Capital is a historic moment both because it is the first BSE company to specialize in venture capital investments and because it occurs during a pandemic. We are convinced that a significant part of our new business history will be written by the startup ecosystem in Bulgaria,” said Manyu Moravenov, Executive Director of Bulgarian Stock Exchange, in an official statement.

On April 22 Eleven Capital was officially listed as a public company setting the foundations of a closer relatiоnship between the startup and innovation ecosystem, and more established players on the capital market. In March, the company announced it had managed to close the initial public offering (IPO) raising a bit over €1M (2.1M BGN). In the course of the past month, a bit over 300K (from 500K issued) shares were subscribed at the price of 7 BGN (€3.58).

“We hope that this move will encourage both worlds to open up to each other. Eventually, the Bulgarian Stock Exchange should become a more obvious choice for raising capital by innovative and high growth companies,” tells us Daniel Tomov, managing director of Eleven Capital.

What does it mean for investors

The public status of Eleven Capital will allow most of its investors to trade shares and have the liquidity that limited partners in traditional VC firms cannot enjoy. Also, it is a new class of assets traded on the Bulgarian Stock Exchange, that on the one hand gives traditional capital market players access to innovative and high growth companies, but also provides cash for the further development of local startups.

Upon listing, all the investors, excluding Eleven Management (lockup 3 years), Karoll (lockup 1 year), and Fusion Capital (lockup 1 year), who together hold 30%, can trade their shares. Prior to the listing, Karoll has registered also as a market maker, which means investors can now buy and sell shares even if there’s no demand. “We don’t expect there will be very active trading during the current turmoils. Our investors have relatively high expectations about the overall returns, while on the other side potential buyers will be quite wary for the time being,” tells us Tomov. Around 90 investors have subscribed shares with an average ticket of 23K BGN ( €11.8K). Most of the investors are Bulgarian, including one pension fund – DSK Rodina and asset management firm Expat Capital, but there are also two individual investors from Greece, tells us the team. Prior to the public offering, around 20 high net worth individuals, mostly tech entrepreneurs, assured the company’s initial capital of around €1M.

+++ All you need to know about Eleven Capital – investors, portfolio and prospectus +++

What does it mean for startups

“We are actively working with the portfolio companies to help them weather the crisis,” says Tomov, referring to the current coronavirus related situation. On the greater scheme of things, the capital raised from the IPO is aimed at boosting the development of the top performers of Eleven’s first fund. Tomov confirms that the money raised from the IPO will go only to support existing portfolio companies.

The portfolio of Eleven Capital currently consists of 34 companies named to be the top performers of Eleven Accelerator, whose successor is the newly listed company. Between 2012 and 2015 the acceleration fund, which was back then 90% funded by the European Investment Fund, invested €12M in 116 early-stage startups. Two years ago, the partners bought back the shares of the EIF, and former Telerik co-founder Vassil Terziev joined Eleven as a partner too. Eleven Capital is now registered as a separate legal entity designed to go public and assure capital for the best-performing companies of the portfolio.

A more detailed look into the numbers shows that 25 of the portfolio companies increased their revenue in 2018, six of them show a drop, and another three have no registered turnover. The top performers of the portfolio (by revenue over 1M BGN in 2018) are Kanbanize, Enhancv, Sensika, Novalogy, and CourseDot. Eleven Capital owns between 7.9% and 19% equity in the companies. The value of the investments in eleven of the companies has decreased, shows also the prospectus. According to the official news release of Karoll, there are eleven key portfolio companies: BI platform developer Sensika, IT education platform Coursedot, digital CV platform Enhancv, task management system Kanbanize, magic paint startup Escreo, cargo drone developer Dronamics, taxi app TaxiMe, data science company A4E, smart bench startup Strawberry Energy, editorial intelligence platform Content Insights, and EEG device mBrainTrain.

What does it mean on an ecosystem level

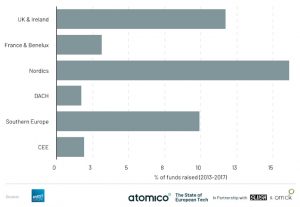

This is probably the most interesting part of the story. The fact that a VC firm goes public indeed opens the door between different worlds – the one, quite dynamic and of the high-growth startup companies, and the other much more conservative one of the large institutional investors like, for instance, pension funds and asset managers whose investments in VC are typically restricted. In Bulgaria, pension funds, that are sitting on around €7B, didn’t really have a mechanism to participate in the innovation game so far (there are by the way also failed IPO attempts of startups – read more), while the experience of other, mostly Western and Northern European, ecosystems shows this may give a boost to both.

In more developed ecosystems, like the Nordic ones and the UK, the pension funds have long been part of the VC landscape. For instance, in Sweden, 16% of the VC comes from them. For example, in 2016 Northzone, an early investor in Spotify, was able to raise its biggest fund of €350M, thanks to investment from two state-owned pension funds. Back in 2016, Tim Draper’s Esprit also went public with the idea to democratize venture capital and managed to attract various capital market players like Woodford Investment Management, the Ireland Strategic Investment Fund, China Huarong International Holdings Ltd, Baillie Gifford, and several other city institutions.

Whether the move of Eleven Capital has the potential to really shake up the ecosystem allowing the big players to diversify their portfolios while boosting local innovation, remains to be seen. In any case, this is a first such move for the region and definitely a new milestone in the development of the ecosystem.