GoStudent loses unicorn status after devaluation by lead investor

If major investor Prosus has its way, Austria will have one less tech unicorn: According to Prosus, GoStudent is now only worth around €900 million (around $970 million), meaning it has lost the unicorn status it achieved in 2021. At that time, investors pushed the Viennese platform for tutors to €1.4 billion in the midst of the startup hype. In 2022, Prosus from the Netherlands joined in, and GoStudent’s valuation doubled to €3 billion.

However, the current annual report of the listed company Prosus shows that GoStudent has experienced a dramatic devaluation. The listed investor, which belongs to the South African Naspers Group, already reduced GoStudent’s valuation by around 30 percent in 2023, down from 3 to 2.1 billion euros. This value is now being more than halved again, by almost 60 percent. Accordingly, GoStudent is now only worth €903 million (or $969 million) to its lead investor.

GoStudent does not want to comment directly on the valuation by Prosus, the lead investor at the time, as their assumptions regarding the valuation cannot be transferred to other shareholders. “We completed our last equity financing round at the beginning of 2022. This was also the last time our valuation was determined. We are very proud of the work we have done since then and continue to focus fully on the sustainable profitability of our company and on creating long-term value for our users and shareholders,” said a GoStudent spokesperson.

It is currently unclear whether the Vienna-based company will continue to describe itself as a unicorn publicly.

GoStudent rating reduced by 70% from 2022 to 2024

In March 2022, major investor Prosus invested $226 million (around €203 million at the time) in GoStudent and received 8 percent of the company’s shares in return. Prosus has thus provided almost a third of the total €675 million that the Viennese company has raised since it was founded in 2016. Prosus was the lead investor in the Series D financing round, which gave GoStudent a company valuation of €3 billion in early 2022, and was later also involved in the last financing round, in which another $95 million was raised in August 2023. It is therefore also relevant when this large investment company makes upgrades or downgrades.

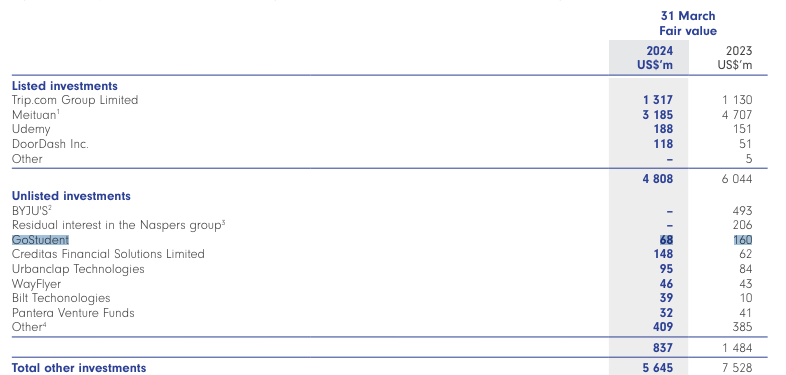

Here is an excerpt from Prosus’ 2024 annual report, which shows the devaluation of GoStudent shares from 2023 to 2024 from $160 million to $68 million (-57.5%):

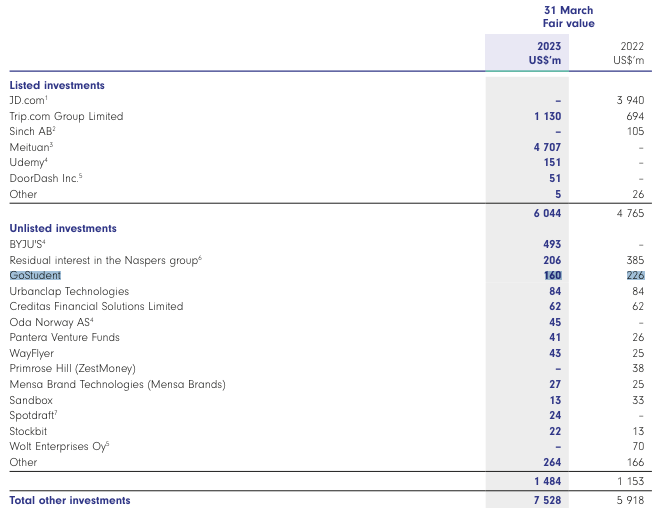

Here is an excerpt from Prosus’ 2023 annual report, which shows the devaluation of GoStudent shares from 2022 to 2023 from $226 million to $160 million (-29.2%):

Overall, Prosus GoStudent has depreciated by 69.9% from 2022 to 2024 (the $226 million invested at that time is now only worth $68 million to Prosus), so the Viennese company has lost more than two-thirds of its value, according to its major investor.

The bottom line is that this gives a new valuation of €903 million (or $969 million), meaning the unicorn status is gone, both in euros and dollars. As a reminder: unicorns are private companies with a valuation of one billion or more.

According to the commercial register, Prosus still holds around 8 percent of GoStudent shares. This means that the write-down did not come about through a (partial) sale of shares (the annual report summarizes the financial year ending March 31, 2024, note ).

EdTech is being shaken up by GenAI

GoStudent is only worth one line to Prosus in the 215 pages of the 2024 annual report – the one in which you can see the devaluation of the shares. In 2023, things were different, as the Vienna-based company was still mentioned in several places to underline the investor’s EdTech strategy.

Keyword EdTech: GoStudent is hit hard by the devaluation of the sector, but not as hard as the Indian EdTech BYJU’S. Prosus has completely written off its 9.6% stake in BYJU’S – meaning a whopping $493 million has simply been set to zero. In general, Prosus is seeing weaker performance in its EdTech investments, and for one main reason: Generative AI, especially ChatGPT, is causing problems for companies. After all, why should other services pay when the OpenAI chatbot is excellent for learning? GoStudent has already reacted to this and launched its own learning bot Amelia, which is more of a wrapper for GPT-4.

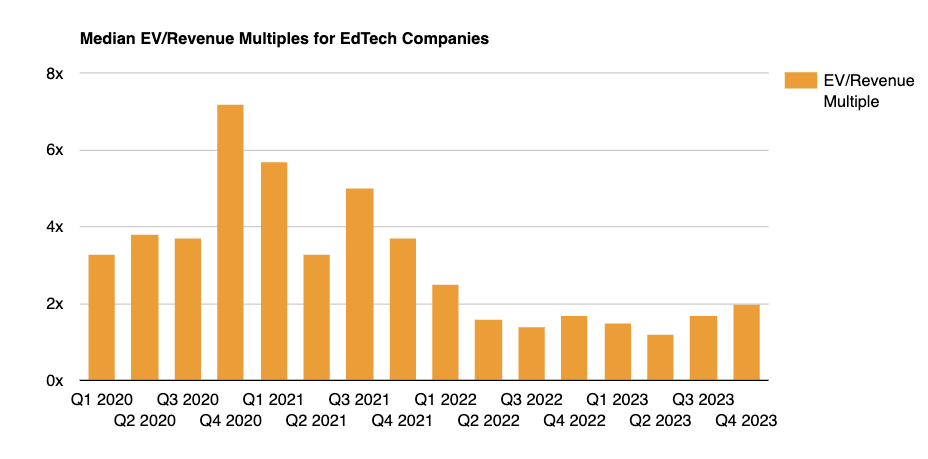

In general, EdTech companies have suffered significant devaluations since the hype year of 2021. “Starting from 2.8x in the first quarter of 2020, revenue multiples almost doubled in the fourth quarter of 2020, reaching a peak of 7.3x. However, as schools reopened in most countries and the sector’s momentum slowed, median revenue multiples fell to 1.2x by the second quarter of 2023. However, an upward trend emerged at the end of last year, and the median revenue multiple for EdTech companies reached a factor of 2 by the fourth quarter of 2023,” says Finerva, for example, regarding valuations in the sector . They have developed as follows:

As reported, GoStudent posted a loss of €221 million in 2022, and after several waves of layoffs and cost-cutting measures, profitability was announced in 2024. The pressure from investors to create growth was probably great, and the company resorted to methods such as operating an alleged comparison portal, the results of which always led to GoStudent itself. However, by focusing on profitability and savings, the growth fantasies that drive unicorn valuations have been lost. This may ultimately have led to the devaluation of GoStudent into more realistic territory.