Playing Your Cards Right To Win In Corporate Innovation

Nikola Likov is heading Expansion at FoundersLane and has helped drive the firm’s growth since its inception days. Today, FoundersLane is a leading corporate venture builder in Climate & Health. They build new digital businesses end-to-end, leveraging the unfair advantage of combining the agility of tech entrepreneurs with the strengths of corporates. Nikola’s journey started as part of Solytic’s validation team (a portfolio venture which has become the fastest-growing solar startup worldwide) after graduating from UK’s Warwick Business School. Today, he leads FoundersLane’s growth and go-to-market and efforts across Europe, Russia and the Middle East.

If you want to become — or remain — a market leader in the new normal, you can’t afford to waste time and resources on “innovation theatre”.

This article will show you the digital tools and vehicles you need to consider when building your winning innovation portfolio. But before we get there, here is the one thing I never suspected of corporate innovation when I first entered the field three years ago.

It’s how you play your hand, not having the best cards

I used to think that companies with the largest budgets win every time. But that’s not true. I’ve now seen many companies throw (and lose) money and resources at activities without a balanced portfolio strategy for their digital initiatives. Lack of strategy wrecks their digital transformation efforts and opens the door to competitors and disruptors.

Only a handful of top innovation executives are managing their portfolios in a concerted, well-aligned manner. Most are opportunistic — buying start-ups, partnering up, investing in others and, increasingly, building their own new ventures as well.

As I kept on seeing these recurring patterns, I began to spot the similarities to the way hopeful gamblers play poker against professionals.

Perhaps corporate innovation and poker weren’t all that different.

Poker, like the market, is fiercely competitive. In one, you bet your valuable chips, in the other your corporate assets. An early fold, an emotional raise and you lose — even if the statistical odds were clearly working in your favour.

The one thing every corporate manager needs to learn from professional poker players:

Winning is determined by how well you play your cards, not by the cards you hold.

Replace “cards” with “innovation tools” and you’ll see why it is crucial to understand the range of digital options available to you and how to play them well.

There are 3 essential plays you need to master

Let’s step away from poker now and talk business.

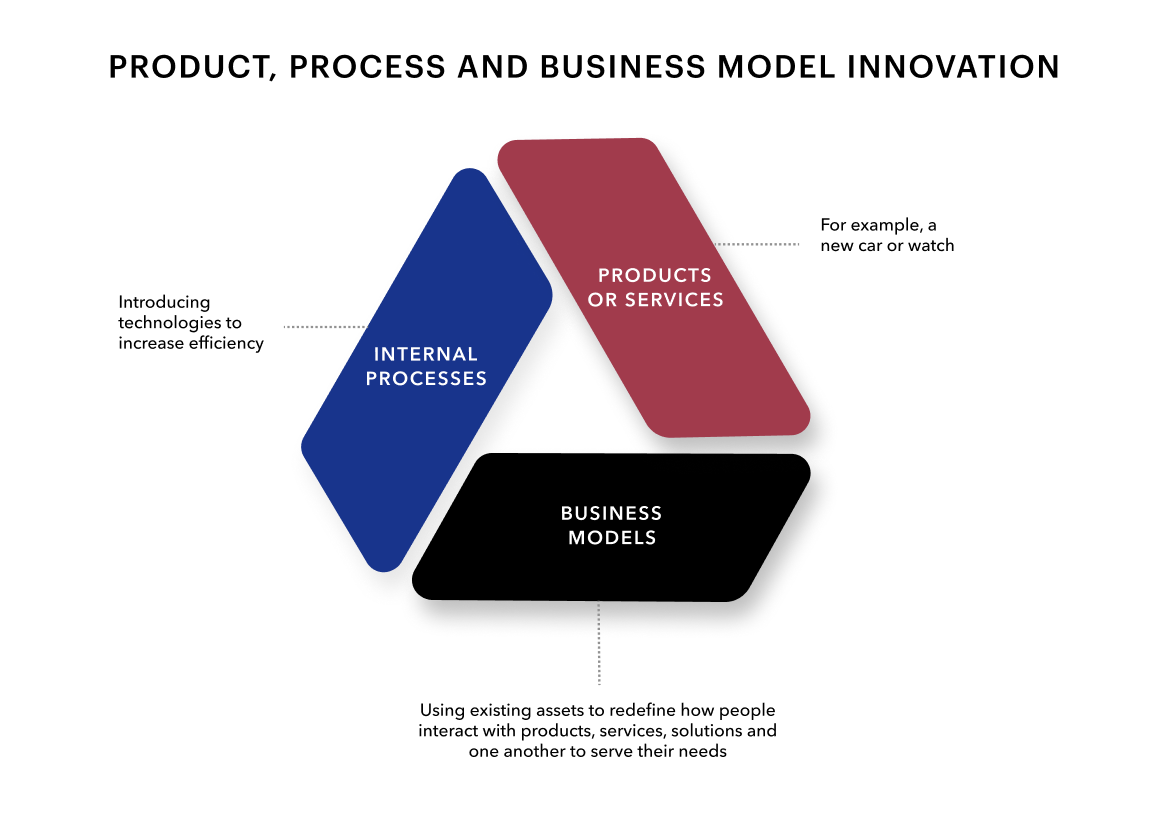

In considering the different types of innovation tools to include in your portfolio, you are generally looking at three fundamental elements — processes, products and business models, as shown in the graphic below.

Previous crises demonstrated this is a timeless rule and one that will hold true even in the new normal. If you aim for market leadership, you’ll need to know how to play each of these elements within the digital tools in your portfolio.

The question is — what tools should you choose in addressing each of the three innovation elements?

In a moment, I’ll talk about the field I know best — corporate venture building — and why it’s fast gaining popularity as an innovation vehicle that complements the traditional options. It’s a vehicle that’s truly effective in creating enterprise value through business model innovation. Before that, though, let’s briefly examine the traditional options at hand and the plays you should master or avoid.

1. Internal Process Innovation

Process automation, R&D, intrapreneurship schemes, strategic partnerships and culture change programmes.

These tools are among the multitude of inhouse approaches to internal process innovation. They mainly lead to incremental innovation, but they are the first steps towards digital transformation.

When internal transformation’s played well

- You maintain control — Internal initiatives like intrapreneurship and R&D generally allow the corporation to maintain full control over the process, minimizing execution risk.

- You optimise processes — Process automation, through technologies like AI and machine learning, drives efficiencies in the core business and prepares your core assets for success in new markets.

- You set out the foundations for transformation — Internal transformation activities create an environment that sets the scene for new digital business models.

When internal transformation’s played badly

- You can’t make the right decisions — Corporate leadership will almost always use core business KPIs and metrics to govern the digital portfolio. Your traditional KPI systems measure what is relevant for the core business, not for the digital ones. You need an ambidextrous approach and a separate operating model. Without it, you can’t make the right decisions and have a structure to build a portfolio of digital growth.

- You’re too slow — Transformation initiatives must be bold and rapid. But the bureaucracy and traditional management methods embedded in most organizations will often slow everything down.

- You waste your potential — In times of crisis, many companies shift into survival mode and shelve new high-tech or internal digital initiatives, even when they are potentially valuable.

Internal process innovation is a good first step, but advanced players will always combine it with product and model innovation.

2. Product Innovation

Many try, and most fail, to execute innovation in products and services. There are thousands of brainstorming labs (and countless sticky notes that come with them), all aimed at dreaming up the new products or services that are seen as being the goal of innovation.

Corporate incubators are a form of internal innovation. In the most common incubator model, ideas that are relevant to the parent company are generated by internal staff, developed and then spun out.

Corporate accelerators are a form of external innovation in which start-ups born “in the wild” apply to participate in time-limited programmes that provide benefits such as mentorship, technical support and capital.

When product innovation’s played well

- You create new product lines — You bring inventions into commercial use by converting them into offerings that can be used or applied and for which there is real demand.

- You impact your culture — Lab activities lead to cultural change and are fantastic for team building, fun and generating ideas for future income streams.

- You cash in — We all know about success stories like McDonald’s spinout of Red Box (sold for $150-plus million) and Axel Springer’s acceleration of N26, the Berlin-based unicorn mobile bank.

When product innovation’s played badly

- You don’t make an impact — If you’re not clear whether those involved in early-stage innovation labs are supposed to serve the core business or disrupt it, you won’t get the results you need.

- You are the roadblock — Lab activities often lack strategic relevance, proper metrics to track success, C-level support, and acceptance within the corporate ecosystem. However, several studies have shown that the success of innovation initiatives is highly dependent on C-level involvement.

- You “direct” theatre — Without a clear, structured, systematic process and dedicated resources to take lab ideas further, the whole endeavour becomes nothing but an exercise in innovation theatre.

A new line of products or services seldom proves truly transformative for the organisation, but professional players do keep this play up their sleeves. Business model innovation is where the real game begins.

3. Business Model Innovation

In their recent bestseller about shaping the new normal, Fightback Now, Felix and Sven of FoundersLane explain that the real transformative potential of a company lies in going beyond launching new products and moving towards using existing assets to redefine how people interact with products, services, solutions, and one another. It is this ability to alter your old ways of operating that can make you a shaper of the new normal.

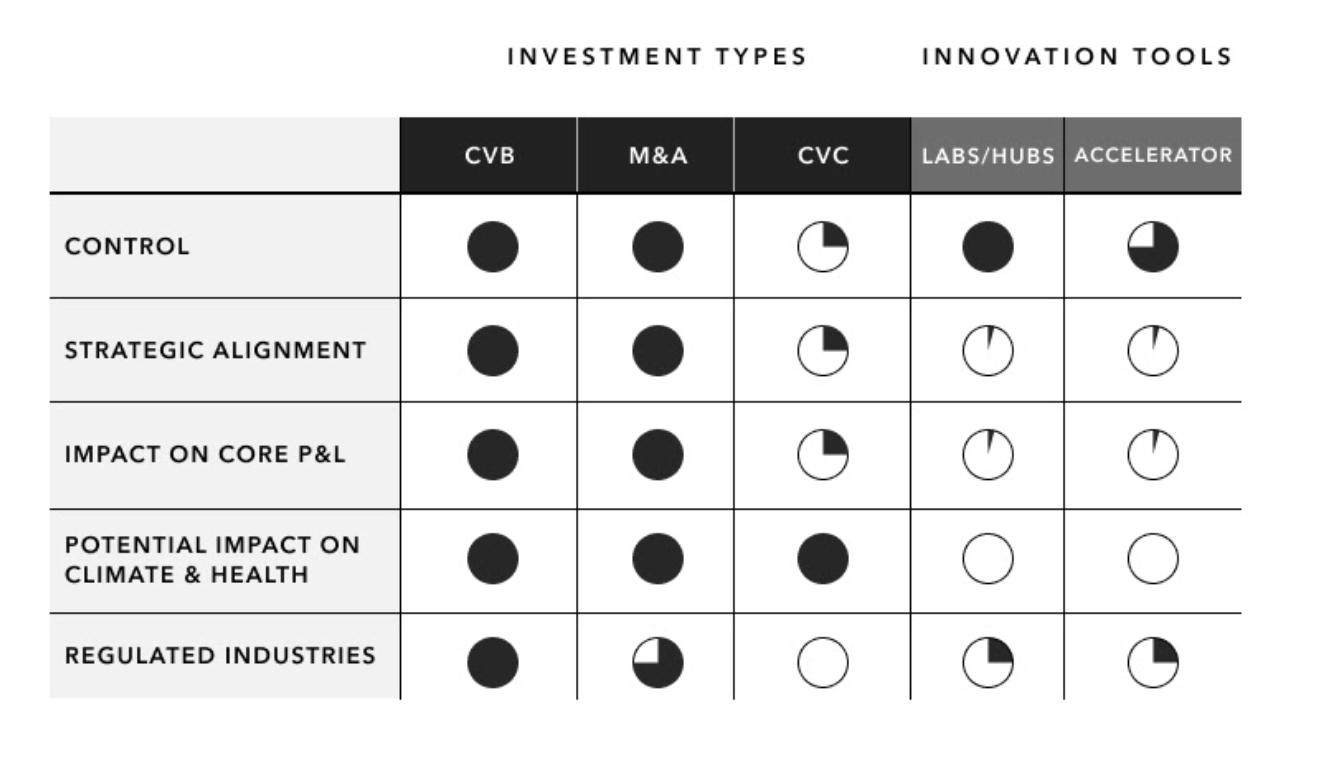

It’s worth taking a look at the strengths and weaknesses of each of the popular asset classes involved in business model innovation.

Corporate Venture Capital (CVC) is a high-risk, high-stakes approach where corporate funds are directly invested in external startups for a mix of strategic and financial objectives. In 2019, TrendingTopics SSE reported that the value of European deals involving CVC reached €14.7 billion, a 52.6% year-on-year increase.

When CVC’s played well

- You can generate returns — A handful of corporates like Intel and GE who successfully utilise expert knowledge and industry access consistently manage to outperform the competition in their markets.

- You synergise with portfolio firms — Corporates gain strategic exposure to technologies and customer bases, as well as products offering synergies with their portfolio companies.

- You hedge disruption threats — Corporate venture capital’s main value is often its ability to provide strategic hedging against the danger of future disruption.

When CVC’s played badly

- You’re crushed by the Sequoias — Standalone VCs like Sequoia and Andreessen Horowitz systematically outperform most CVCs in terms of returns, fund size and top-tier talent acquisition.

- You miss the synergies — All too often, there is little knowledge transfer between the portfolio firms and the main corporate body, despite everyone’s good intentions.

- You fail to transform the business model — No real assets can be fed back into the core business if financial returns and strategic synergies fail, which — given today’s competitive markets — is a real risk.

Mergers & Acquisitions (M&A) is an established way to bring external innovation under corporate control. The principle behind any M&A is 2+2=5. But you can’t acquire what doesn’t exist or isn’t a good fit, which is often the case in highly regulated industries like healthcare.

When M&A’s played well

- You accelerate innovation — If you can acquire the right target firm, you can internalize its R&D capabilities and rapidly improve your capacity to innovate.

- The pond gets smaller — Market competition is reduced and knowledge transfer is strengthened by merging innovative resources from both sides.

- You’re a bigger fish — Increased market share puts you at a competitive advantage as your buying power, economies of scale and technology capabilities increase.

When M&A’s played badly

- You’re on the losing side — By the time a start-up appears on the corporate’s radar, it will usually have gathered enough momentum to guarantee the price you pay will be too high.

- You kill the spirit — Start-ups typically have a strong culture and fiercely independent founders. Either you leave the culture as it is, or you kill it. Both options are problematic and will limit the potential impact on your P&L.

- You create conflict — What looks good on paper can quickly become a nightmare because of cultural misalignment, personality clashes and disagreements about goals.

Corporate Venture Building (CVB) is a new vehicle for innovation and business model transformation.

In poker speak, to have a card up your sleeve is to have a hidden advantage.

At FoundersLane, the leading corporate venture builder in health and climate, we’ve so far helped over 30 corporates from across 3 continents build successful impact ventures. The “hidden advantage” analogy to poker was proven every time.

CVB is not a substitute for the previously mentioned innovation options but provides a powerful complement to them.

CVB is the only tool that enables corporations to fully leverage their existing assets in building new digital businesses outside the core organization.

As Standard Chartered Ventures CEO Alex Manson said in his interview for FightBack Now:

“Trying them out on the inside would be difficult and too much counter to the organization’s nature — not just because of the corporate antibodies, but because the company is not set up to do it. That’s why you need to create them outside.”

Because these new digital businesses are designed around your unique assets and the white spaces you have uncovered in your market, they will always be strategically aligned and relevant to the future of the core organization.

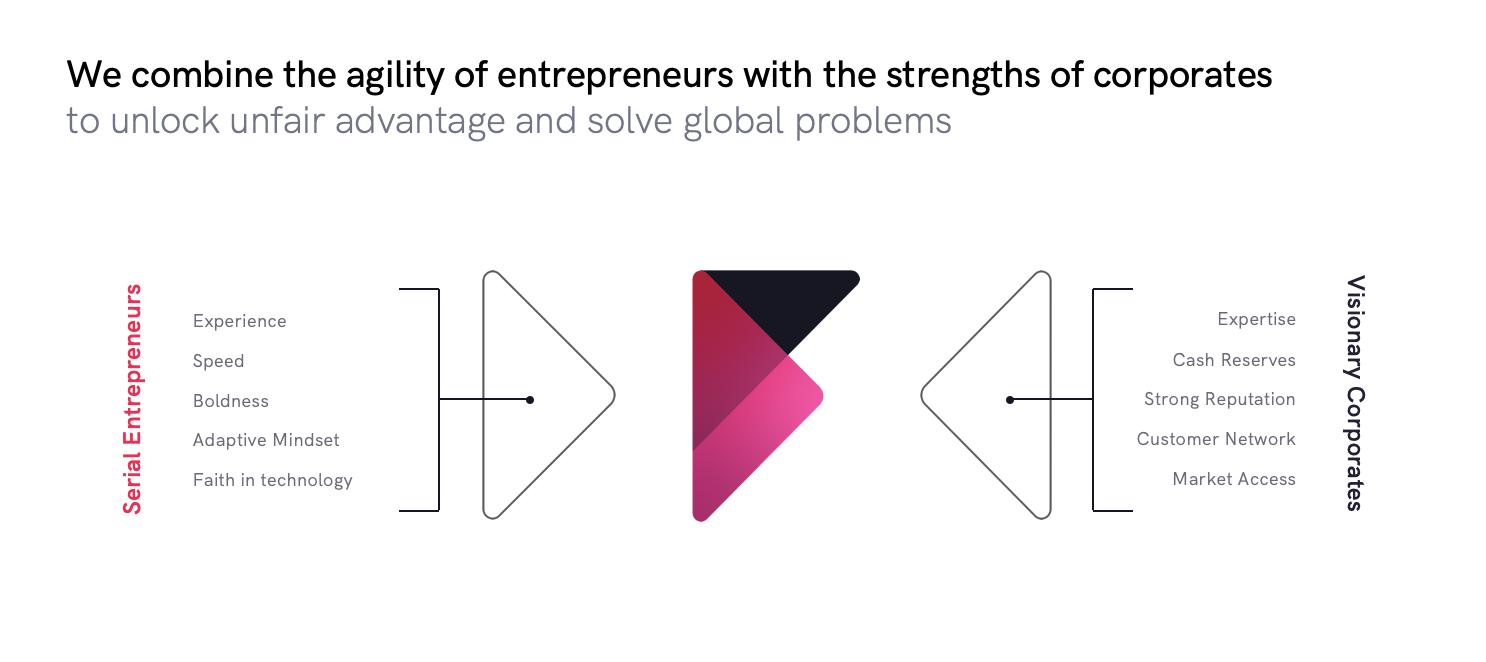

Any new venture comes with a risk of failure. The CVB model minimises risk by bringing together the strengths of corporates and tech entrepreneurs. This combined expertise adds up to an unfair advantage.

The secret sauce is a shared equity incentive structure designed to provide powerful incentives for rapid execution and position the collaboration for long-term success.

When CVB’s played well

- You leverage your existing assets — CVB gives you the ability to make the most of underutilized corporate resources, discover and exploit white spaces and build new value with tailor-made business models.

- You ensure strategic alignment — CVB requires the kind of board-level commitment that will ensure permanent and relevant business model innovation.

- You build what’s complex and meaningful — CVB is well suited to tackling complex problems in highly regulated science-based markets like healthcare and climate-related industries. Everyone does what they’re best at — the serial entrepreneurs do the building and you do the growing.

When CVB’s played badly

- You destroy the relationship — The shared incentive model demands the kind of close collaboration between venture builders and corporates that is crucially dependent on real commitment, energy and a willingness on both sides to invest substantial resources.

- You don’t stick around long enough to see results — It takes time for a digital venture to start growing exponentially and provide abnormal returns. Solytic, the solar analytics platform FoundersLane built with and for Vattenfall, has taken four challenging years to take off and become the world’s fastest-growing solar start-up.

- You’re stuck in the old ways — It’s only natural that orthodoxies and assumptions associated with past successes tend to rule your business. Success in the digital world, however, will only come if you are open to entrepreneurial thinking and new ways of doing.

Winning in corporate innovation

If we fail in the face of today’s global challenges, the measure of humanity’s tragedy will be the distance between what we could have done with our assets (technologies, connections, data and so on) and what we are actually able to achieve.

The market winners in the new normal will have a greater responsibility to their customers and the broader community than any of their predecessors.

If you’re aiming to be one of them, you will need to leverage your existing assets in new and meaningful ways and develop sustainable, efficient and innovative ways of operating, based on new processes, products and business models.

This is how you play your cards right in the new normal.

Inevitably, this article has only provided a high-level overview of the digital tools and models to consider when building a winning innovation portfolio. If it has left you curious to learn more about corporate venture building or the methods FoundersLane implements to help corporates balance their digital portfolios, drop me a line here and let’s set up a quick chat.

As it turns out, poker and corporate innovation do have quite a lot in common.

In both cases, you’re trying to be professional and play your cards right to maximise the value of your chips, instead of gambling them away. It’s going to take skill, judgement, imagination, resilience and intuition.

As Phil Hellmuth — one of poker’s legendary players, with career earnings of nearly $25m — put it, when he was asked to describe what separates the professional players from the gamblers:

“If there weren’t luck involved, I would win every time.”