Product vs Service Startup: Case Study from Bulgaria

As young digital startups are born and refine their business models they inevitably stumble upon the trillion-dollar question – should this innovative idea of theirs be sold as a service or as a full-fledged product. While the idea to be a product company has its luster, many a service firm has richly benefited from its position. To answer the question reasonably conclusively, we decided to go through the troves of data that the Innovationship survey offers on the Bulgarian digital ecosystem.

The first wave of the survey took place in 2016, the most recent data is from 2017, and currently the 2018 edition is under way, and promising to bring new surprising insights. Here, we take the 2017 data, covering some 216 firms that responded which is a pretty good sample of the ecosystem. Sure, we may want it to be precisely statistically sampled and revel in meticulously controlled error rates but given its dynamism and fuzziness, this is probably the closest we get to representativeness. And give or take a percent here or there, results are probably pretty close to reality.

The Startup Service Economy

The first major thing we see is an overwhelming focus on digital service. Despite the hipster image of the visionary founder working on the next-generation robot or at least a 3D-printed pair of shoes, the truth is that overwhelmingly Bulgarian digital companies offer services. The number of service-oriented companies (42%) is almost twice as high as those brave enough to offer a product (23%). Still a lot of companies (28%) focus on the traditional services but enhanced with the use of digital technologies. Overall the service approach dominates the sample with 70% of firms doing just that, and 7% more being too shy to admit it.

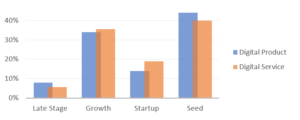

Behind the Stages

Focusing on the truly digital companies and their level of development, there is a strange observation. And it is that there is rather little difference in terms of how product vs. service companies develop, and this difference is present at only some stages. Slightly more digital product companies are in the seed stage compared to service ones, and quite a bit more service companies are in the startup stage as compared to product ones. Such early stage ventures are indicative, but the key question is how many of those progress to the later stages and can stage a true claim to global markets. While an almost equal amount of product and service companies are in the growth stage (34 and 36% for the number nerds among us), somewhat more product companies are in late stage (8% compared to 6%).

Twin Peaks and Twin Bottoms

While stage of development is a neat indicator, it appears on very few balance sheets. Shuffling through hard-nosed revenue data may be a better measure of success. Our data presents a fascinating picture of revenue. The product companies experience twin peaks, the service ones – twin bottoms. Almost a third of the studied startups and SMEs in Innovationship 2017 have very little to show in revenue – less than 25,000 EUR. Then in the segment 25-50,000 and the segment 151-500,000 EUR is dominated by service ones. After the peak at 0.5 million in revenue their relative percentage in the segment declines. On the other hand – product companies find it difficult to break the 150,000 EUR barrier. In fact, it is much easier to break this glass ceiling and make a million in revenue if you are into services. But if you want to make it big – you must bet on a product. Among the product companies fully 11% are making more than 1.5 Million EUR annually. Only 4% of service companies have this distinction.

Berry picking and whale hunting

The answer to the eternal question about whether to productize or be a anything as a Service company boils down to what you want your future trajectory to be. Service companies seem to accelerate faster and make it easily past 150,000 EUR in revenue and into the million. However, if you are into the long-haul and trying to build the next unicorn, chances are three times better if you bravely venture into the product space. So, berry picking or whale hunting?

Anton Gerunov is Associate Professor at the Sofia University and COO of LogSentinel, a Bulgarian information security blockchain startup. Prior to that Gerunov was counselor in the Bulgarian Council of Ministers.