Reddit: 6 unexpected facts about the IPO

It is a highly anticipated IPO that could value the social media platform at five billion dollars: Reddit published its prospectus on Friday night to give potential investors in the IPO a comprehensive picture of the business and risks. As usual in such an S-1 filing, there is plenty of new information that a company has not previously disclosed. Here is the best of it:

1. OpenAI CEO Sam Altman owns 8.7%

Who actually owns Reddit? The largest shareholder, with around 30 percent, is the New York media company Advance Publications, which publishes, among others, The New Yorker, Vanity Fair, and GQ. The Chinese software giant Tencent (WeChat) holds another 11 percent. But who else is among the company’s largest shareholders?

OpenAI CEO Sam Altman (or companies affiliated with him) owns 8.7 percent according to the prospectus. Don’t be surprised, there is some logic behind it. Reddit is one of the startups that emerged from the well-known startup incubator Y Combinator – and Sam Altman worked there for a long time in various roles, so he has been quite very close to Reddit.

In 2014, Reddit raised $50 million in a financing round led by Altman, along with investors Marc Andreessen, Peter Thiel, Ron Conway, Snoop Dogg, and Jared Leto. The company was valued at $500 million at the time. If Reddit were valued at about $5 billion in the IPO, Altman’s shares would be worth about $435 million.

2. ChatGPT is part of the competition

- For searching information: Google, Amazon, YouTube, Wikipedia, X, and other news sites. Some users also turn to LLMs like ChatGPT, Gemini, and Anthropic.

- For entertainment: Meta (including Facebook, Instagram, Threads and WhatsApp), YouTube, Snap, X, TikTok, Roblox and Twitch

- For hobbies: Facebook groups, Discord, X, and Pinterest.

- For peer-to-peer trading: Facebook Marketplace, Nextdoor, Craigslist, Poshmark, Etsy and Roblox.

3. Still making losses 18 years after it was founded

Reddit was founded in 2005 by Steve Huffman and Alexis Ohanian and then sold to the magazine publisher Conde Nast in 2006. It was later spun off again as an independent company, and several rounds of financing followed over the years.

But Reddit was still making losses until 2023, i.e. 18 years after its launch. In 2023, there was a net loss of $90.8 million and a negative adjusted EBITDA of $69.3 million. In 2022 there was a net loss of $158.6 million and a negative adjusted EBITDA of $108.4 million. The reduction in losses is thanks to a sharp increase in revenue: Reddit made $800 million in revenue in 2023, up from $666.7 million in 2022.

The deficit accumulated over the years is $716.6 million. There is little or nothing in the stock market prospectus about when you might become profitable. Rather, it warns: “We have incurred net losses in the past and may not be able to achieve or maintain profitability in the future.” And it says: “We are in the early stages of monetizing our business and there are no guarantees. We will be able to scale our business for future growth.”

4. Google buys Reddit data for AI training

Thanks to the AI hype, Reddit has discovered a new source of revenue: selling user data (especially postings) to AI companies that can use it to train their LLMs in human-written language. A big customer is Google, which is currently fighting the dominance of ChatGPT and OpenAI with its new LLM Gemini and open-source models.

Logically, Reddit wants to capitalize on its user data. As a source, it is positioned quite uniquely, since Meta, with its subsidiaries Instagram, Facebook, and WhatsApp, sits on the bulk of user-generated content and certainly does not hand it out to Google and Co. so that they can train their LLMs with it.

This licensing of user data to other companies is expected to bring in $203 million for Reddit over the next two to three years. Of that, $66.4 million in revenue will be recognized by the end of 2024 – that’s probably largely the Google deal.

5. Redditors’ whims pose a threat to business

Reddit reserved shares in the IPO for its loyal users. Redditors, especially the core group of subreddit forums, are considered to be very critical of the company. There have often been protests and blockages when changes have been made. And they do not like the fact that Reddit sells user data to Google and Co for AI training.

That’s why the mood of Redditors is also a threat to future business: “If Redditors do not continue to contribute content or their contributions are not valuable or appealing to other Redditors, we could see a decline in the number of Redditos accessing our products and services. and user engagement, which could result in a loss of advertisers and harm our reputation, business, results of operations, financial condition, and prospects,” the prospectus states.

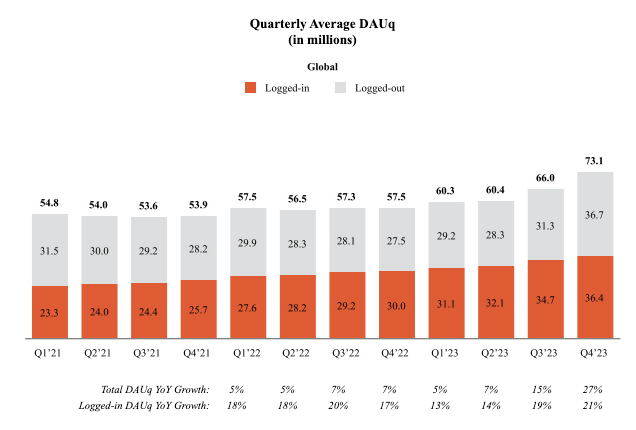

6. Lots of users without accounts

Reddit is a little afraid of comparisons to other (social) media sites and does not report its user numbers in the usual monthly active users (MAU), but rather in daily active users (DAU). You can see that after strong growth there was an average of 73.1 million (Q4 2023). Why Reddit has to count it this way will soon become clear: More than half of the users are not logged in when they visit the site, so in times of cookie blockers and the like it cannot be counted clearly – it would work better if they did Page can only really be used when users are logged in (like Meta).