The Altcoin Season has officially begun – what does it bring?

First the ETFs, then the halving, and now the rally following Trump’s election victory towards $100,000: This crypto year has been dominated by Bitcoin so far. But with the start of March, various trackers that specialize in altcoins and measure their performance have now struck: It’s altcoin season again.

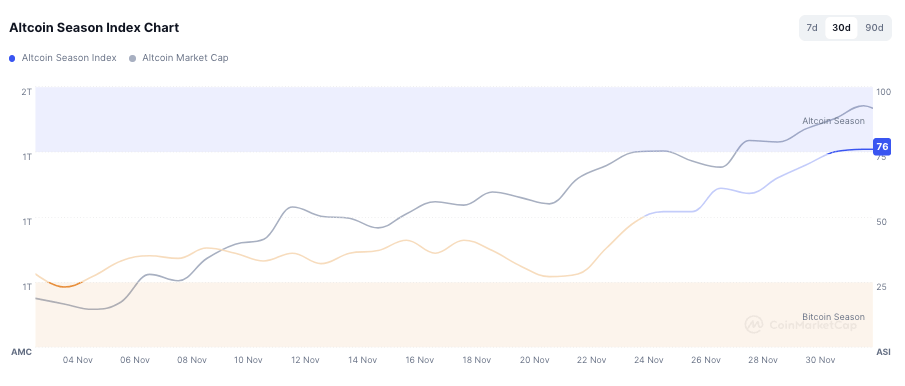

Altcoin generally means that crypto assets other than Bitcoin are experiencing particularly strong price increases and attention. At CoinMarketCap, which is essentially the home page of the crypto world, the altcoin season is defined as follows: If 75% of the top 100 coins have performed better than Bitcoin in the last 90 days, then it is altcoin season. Stablecoins such as Tether and DAl as well as asset-backed tokens such as WBTC, stETH and cLINK are not included in order not to cause distortions.

The Blockchain Center‘s Altcoin Season is a bit stricter and only uses the top 50 coins for analysis and then measures at what point 75% of them performed better than Bitcoin in the last 90 days. This tracker is now also set to “Altcoin Season”.

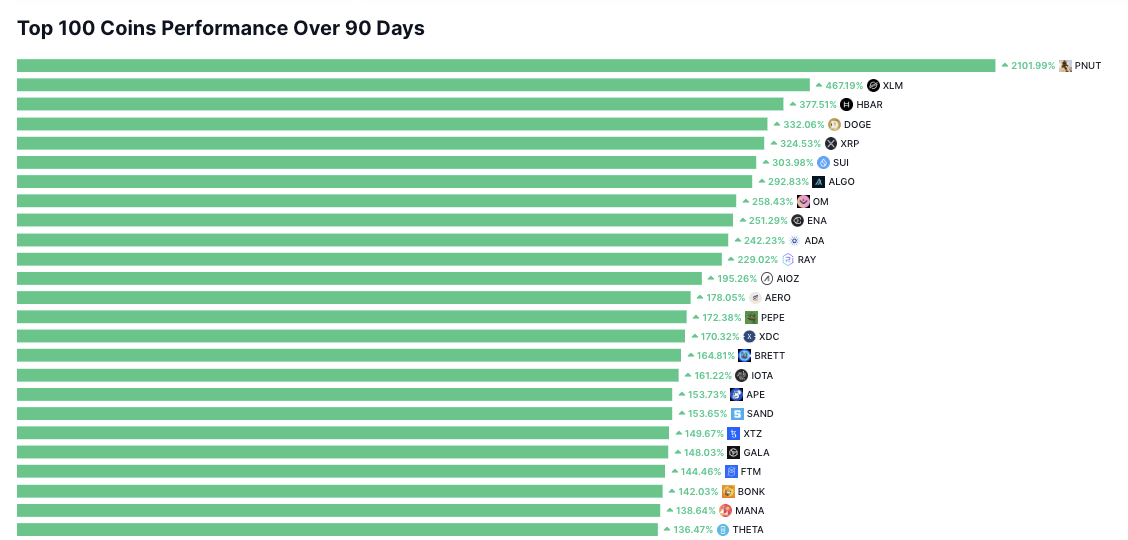

What is interesting is that, contrary to expectations, the altcoins are not only driven by the pump & dump around memecoins, but also by the growth of serious tokens such as XRP and its little sister XLM, or the Ethereum alternatives SUI or Cardano (ADA):

Altcoins are grabbing market share from Bitcoin

This phase is characterized by increased attention to cryptocurrencies beyond Bitcoin, with the total market volume of altcoins increasing in percentage terms and their prices being more dynamic than those of Bitcoin. What we will see this altcoin season remains to be seen. In the last hype, for example, the narrative was very much focused on NFTs, which later flopped quite a bit. It is quite possible that old concepts such as DeFi or GameFi will be unpacked again, or attempts will be made to score points with new narratives (DePIN, memes).

Market activity during an altcoin season is typically characterized by speculative optimism and the hope of high returns. Investors show increased interest in smaller and medium-sized cryptocurrencies, which leads to increased trading volume and sometimes significant price increases. The mood is characterized by a pronounced FOMO (fear of missing out) effect, in which investors invest more in various altcoins for fear of missing out on a profit opportunity.

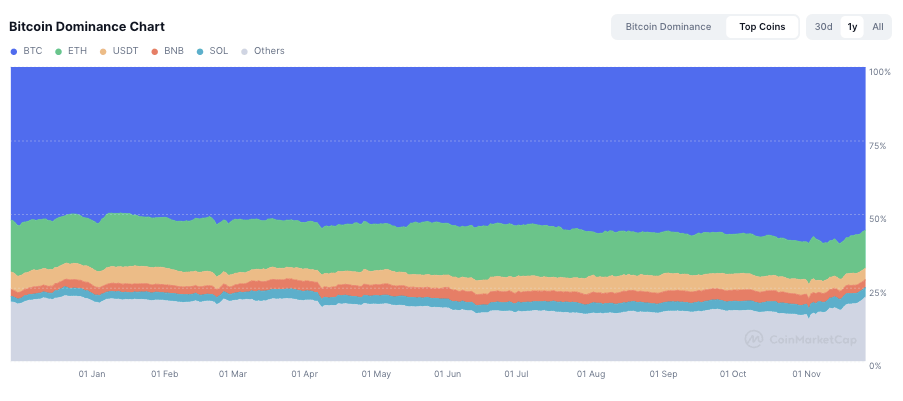

What the altcoin season logically also means is that Bitcoin dominance (BTC market share in the total market) is falling due to strong growth in altcoins. In the last altcoin season in May 2021, the combined market capitalization of the 100 most important altcoins reached around 130% of that of Bitcoin, and BTC dominance fell to less than 40 percent. Since then, it has risen again to around 60 percent, and is currently falling steadily – currently to around 55 percent:

Important for exchanges and startups

You can think what you want about altcoins, Bitcoin hardliners even throw them all into the shitcoin pot. But other parts of the crypto industry are betting heavily on them. On the one hand, volatile altcoins are important for crypto exchanges because they generate high trading volumes and lively trading activity, which in turn leads to increasing revenue in the form of trading fees.

On the other hand, altcoins are a tool for startups to try out new concepts and provide investors and the community with an investment tool. This in turn is good for smart contract networks such as Ethereum, Solana, Avalanche, or Cardano because they serve as platforms for new altcoins.

In recent years, the US Securities and Exchange Commission (SEC) has waged a real war against altcoins because its current CEO Gary Gensler believes that all altcoins should be considered securities that are subject to US securities laws. Gensler has now announced his resignation parallel to Donald Trump’s inauguration. It is therefore expected that there will be a much more crypto-friendly US policy so that altcoins no longer have to fear SEC lawsuits. This is ensuring that more companies are now investing in cryptocurrencies alongside Bitcoin.