The “everything is going digital” narrative is dead

When, after the lockdowns of 2020 and 2021, the big rain of money suddenly came to the world of startups, scale-ups and unicorns, it was heard everywhere: politicians, management consultants, founders, and those who would become one everyone wanted to hear: “COVID is the turbo booster for digital transformation”. Education, shopping, entertainment, the world of work, events, even the entire financial system – digitalization will not stop at anything.

It was somehow clear: After the (wealthy Western) world had spent the lockdowns in front of displays at home and everything somehow worked quite well, it was logical: everything will move even more and faster into the digital world. Mark Zuckerberg’s large-scale Metaverse plans, which have so far resulted in a whopping $47 billion (!) loss, are a product of this time – in 2021 Facebook became Meta.

But when an Austrian VC recently asked me the name of our printing company (which produces our pretty great Trending Topics magazines ), it was confirmation of a thesis that had been forming in my head for a long time: the digitalization narrative is dead, at least for now. No one anymore, neither in press releases nor on stages, uses catchphrases like “digitization acceleration” or “turbo of digital transformation” anymore. The world has changed too much for that due to the war in Ukraine, the interest rate turnaround, the energy crisis, and the Middle East conflict.

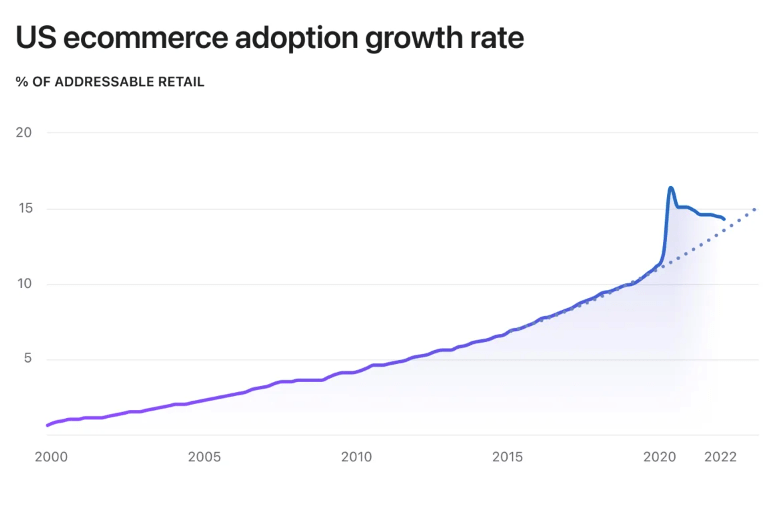

You can see on both a large and a small scale that digitalization no longer has a turbocharger. When CEO Tobias Lübke had to announce in mid-2022 that he would be cutting 1,000 jobs at the listed e-commerce giant Shopify, he also posted the following graphic about the growth rate of e-commerce in the USA – it shows a peak in 2021 and then increases again afterward fall.

Offline is becoming the new online

You can see in many places, both large and small, that the digitalization avalanche will not sweep everything away, but rather has been stopped for the time being. According to a study by EY Austria, the number of companies for which digital technologies play a major role in their own business model fell from 67 to 63 percent from 2022 to 2023. An example where the online shop, although it was at the beginning of the company, no longer plays a role is markta. The once “digital farmer’s shop” is no longer digital – it only exists in its offline version, as a shop in Vienna. At the same time, you can watch the quick commerce services Flink, Gorillas and Getir, which were hyped not so long ago, dying out. With wise foresight, we already headlined the most important retail trend in the 2023 Trending Topics magazine: “ Back to Offline. “

Digital events are just a break filler and not a revolution

But it is not only particularly clear in retail that digitalization is on the decline, it is also the case in the event sector. The British digital events startup Hopin was turned into a $6.5 billion unicorn during the COVID pandemic. By the end of 2023, Hopin was no longer worth anything – and people had long since returned to physical events. By the way, a House of Digitalization opened in Tulln at the end of 2022 – as a physical place for networking people and companies with digital interests.

In Europe, the car industry is currently making efforts to install more real buttons in cars and not banish all functions to digital displays. Sometimes a handy button is simply better than a virtual button in software. Would you like another example? GoStudent, the digital tutoring platform, bought the learning provider Studienkreis at the end of 2022, which offers tutoring for students at 900 locations. Learning is not just digital, but needs a physical component.

The fact that digitalization has reached a (temporary?) plateau is currently being felt by the VC industry, which has been at the forefront of digitalization storytelling in recent years. As reported, venture capitalists were able to raise as little money as never before in the first quarter of 2024 – their investors (pension funds, insurance companies, family offices, etc.) are on the brake pedal. After huge overvaluations of crypto, fintech or software unicorns and massive bankruptcies (FTX et al.), there is currently hardly anyone who wants to invest the next billion in new tech funds.

“A great global experiment”

“It was a big global experiment. A lot of capital has been reallocated from public to private to generate global digital profits. From today’s perspective, this experiment did not work. Many of the startups that were financed in this way did not manage to translate this enormous capital into a sustainable, global competitive advantage,” said Oliver Holle, CEO of Speedinvest, at the end of 2023 about the hype years of 2021 and 2022, in which sums have been pumped into digital companies like never before. Now the industry continues to hope for an IPO window so that the many unicorns can go public and their investors can liquidate the shares they have purchased. But the IPO window isn’t really opening, and many investors are still sitting on digital startup shares that they can hardly sell.

Meanwhile, one category of companies in particular is benefiting from the digitalization boom: Big Tech. Amazon, Linkedin, Meta, Google, Apple, TikTok – they have the platforms through which hundreds of thousands of new startups and millions of other companies try to bring their new digital services and apps to consumers every year. The “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) are the ones who benefited massively in 2023, while startups began to die in Austria, Germany and many other countries because the financing level became a desert.

Digitalization doesn’t work for everyone.