The Greek Early-Stage Startups Specialize In Life Sciences And E-Commerce

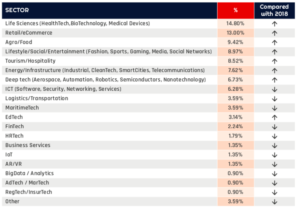

Contrary to the expectations that in a country where tourism forms around 30% of the GDP, travel tech would be the focus of its startup ecosystem, innovative early-stage venture founders in Greece have other problems to solve. Life sciences, med-tech, biotech, and e-commerce is what the Greek ecosystem mostly focused on in 2019, shows a new report by tech hub Found.ation, EIT Digital, and pre-seed VC Velocity. The mapping of the Greek ecosystem is published annually and it aims to reveal investment opportunities and the impact of the digital economy in the country, and potentially to serve as a foundation for forming a national strategy for innovation development.

Alongside the currently hottest sectors, there are also others seen as important factors for the further economic development of the country. Two prime candidate sectors are obviously maritime (maritime- tech) and tourism (travel-tech), yet we can also look for overlooked areas such as the creative industries or even impact investing. These are areas in which technology acts as a catalyst for change, financial inclusion, access to education and jobs,” comments Dimitris Kalavros-Gousiou, partner at Velocity.

The current state of early-stage tech

With the ecosystem in Greece still being young, small in size, and not yet adopting a distinguished orientation, new founders are not urged to focus on a specific sector of the industry, reads the report. A noticeable shift can be seen in the most popular sectors. While HealthTech and TravelTech still remain at top positions, there is a significant rise in sectors such as Retail, Agro & Food, and Energy, following the global market trends, but also because of a plethora of competitions and grants offered to these sectors at the moment.

At the top of the specialization list are Life Sciences, with HealthTech being the sector contributing the most to this high percentage. This percentage grew by over 9% in comparison with 2018. The researchers have two possible explanations: insufficient funding for medically-oriented research could serve as a possible explanation to this finding leading to founding startups and looking for venture capital, on the one hand, but also the continuing global trend of increased funding for startups active in the Health sector, on the other. The aging population and the increased availability of sensors able to track and analyze biological activities could also be seen as factors, note the authors.

According to the most recent data, tourism has contributed to creating 25,9% of total employment, as well as between 25,7% and 30,9% of the country’s GDP (€47.4 – €57.1b) in 2018. Therefore, it comes as no surprise that the representation of tourism and hospitality remains strong on the list, with 8,52%. Nevertheless, tourism was placed third, according to the 2018 data, while this year it dropped by two positions. The emergence of Retail & eCommerce and Agro & Food demonstrates two interesting markets full of opportunities for the Greek startups.

Interestingly enough, fintech drops from the third position in 2018 to the twelfth last year, giving way to other sectors such as Maritime Tech and Transportation & Logistics.

The vast majority is targeting business customers

The focus of the startups active in the early stage of development, as defined by the commercial transactions among companies and their clients, is on Business to Business (B2B) services, who constitute more than half (51.1%) of the companies listed. Another 23.93% of companies are engaged in Business to Consumer (B2C) activities.

The long history of tourism and travel, as well as other B2C products and services surrounding them is encapsulated in this percentage, suggesting that entrepreneurs continue following this tradition. At the same time, the data concerning B2B and B2C businesses suggest that there is a shift from the more familiar to the Greek entrepreneur B2C model towards B2B services.

While performing year on year comparisons, in 2019 we notice an increase in the number of companies targeting both the consumers directly and other businesses. While in 2018 there was a 15% of startups active in the B2B/B2C sectors, in 2019 this percentage rose to 23,3%, raising the total percentage of listed startups in our database to 18%.

A young ecosystem that needs support

In the midst of a historic crisis of our country, a new generation of tech companies emerged, that not only directly helped the asthenic Greek economy during its dark years, but also created a new paradigm and an example for the years to come. New, emerging teams of highly educated Greeks decided to stay and leverage their work experience and skills in building market-defining technology solutions that have the potential to dominate global markets, writes Dimitris Kalavros-Gousiou.

“What needs to be done now is to keep the momentum, develop more the start-up ecosystem and make sure that its roots are getting deeper and deeper in the Greek business environment,” states Yannis Tsakiris, Deputy Minister for Development & Investments. According to him, the state makes a continuous effort, particularly through legislation, to set the enabling conditions for the strengthening of the start-up environment, through simplification of companies’ establishment procedures, proper stock options plans regulations, insolvency, and many more. In terms of financing, up to €400M are expected to flow into the Greek startup, innovation and entrepreneurial ecosystem in the next years through the governmental fund-of-funds EquiFund.