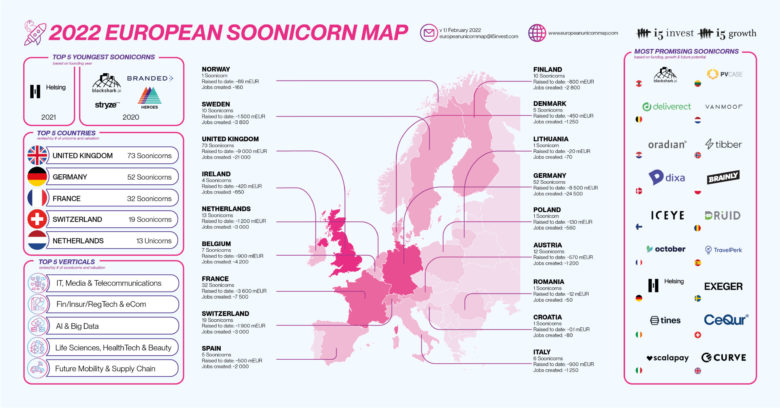

Report: These are the European Soonicorns

The European Tech Ecosystem is developing at a rapid pace. According to a recent report published by i5invest, currently, there are 132 unicorns, 253 soonicorns, and 46 exited unicorns in Europe. In a nutshell, there are more startups than ever and 2021 alone brought almost 100 new unicorns to Europe.

The 2022 European unicorn and soonicorn report sheds light on Europe’s most promising companies creating an impact well beyond the continent’s borders. It is an outlook of what the European startup ecosystem could expect in the months and years.

The information for the report has been collected throughout 2021 and the first weeks of 2022. But the creators missed something. Here is a hint: Just a few days after the report was published, the number of unicorns in Europe grew. Bulgaria has officially produced its first unicorn – the fintech Paywhawk.

So, what is a soonicorn?

It is important to use the terminology right. According to the report, soonicorns are companies that are expected to achieve unicorn status in the next 24 months. This, however, could be quite subjective but still offers a general perspective on the most promising businesses in Europe. Not long ago, another report predicted that the CEE has 25 “digital dragons” that could reach unicorn status in the near future.

In the case of unicorns, the authors stick to the common definition – a tech company with a valuation of at least $1 billion. The exited unicorns are the companies that are no longer privately owned or no longer in operation. In that case, their valuation was either achieved in an equity financing round, a public listing, or an acquisition.

Hidden Unicorns: The CEE-region already has 36 “Digital Phoenixes” to offer

(Soonish-)unicorn breeding hotspots

The UK, Germany, France, Sweden, and Austria are home to the most European unicorns with a total of over 115 unicorns and potential 144 soonicorns. It is expected that the future $1 billion companies will also originate from there but.. who knows. In Eastern Europe, Poland, Lithuania, Romania, Croatia, and Estonia are the countries that are expected to produce a few unicorns in the next year or two.

The Eastern European soonicorns according to i5invest are:

- Oradian, FinTech from Croatia

- DRUID, AI & Big Data from Romania

- PVcase, Sustainability & Energy from Lithuania

- Brainly, EduTech from Poland

However, growth requires investment. Europe’s venture capital ecosystem has continued to grow every year, yet data shows that 48% of all investors in unicorns originate from outside of Europe, predominantly the US. The report highlights the importance of Non-European funding for the growth of high-valued homegrown tech companies in the European region. It is no secret that investors often get better deals in Europe than in the US. In terms of “local investments”, the majority of funding comes from VCs from the UK, Ireland, and the DACH region (Germany, Austria, Switzerland).

Who is behind the report?

i5invest is an international tech M&A firm, investor, and venture builder, based in Austria. The primary focus of i5invest and i5growth is supporting growth and managing corporate development and cross-border M&A processes for extraordinary tech companies.