Top 10 Decentralized Finance Projects in Europe (Part 1)

Into blockchain technology since 2013, Vladislav Dramaliev is one of the founders of the Bulgarian crypto community. Head of Communications in the æternity blockchain project for three years, Vlad is currently focused on his crypto donation platform BitHope.org, the monthly Sofia Crypto Meetup event, and Decentralized Finance applications.

- The price of Ether has outperformed that of Bitcoin in 2020, fuelled by the phenomenal growth of the DeFi space.

- Most of the DeFi projects are established in the US, but Europe is also nurturing a DeFi community.

- In the following two-part series we give a brief overview of the 10 European projects that have either already generated traction, and/or have developed a unique solution to a problem in the DeFi space.

- The first five are offering services that are exceedingly sought-after by DeFi users including lending/borrowing, smart contract insurance, real-world asset securitization and tokenization, trustless exchange, and crypto and token payments in the real-world.

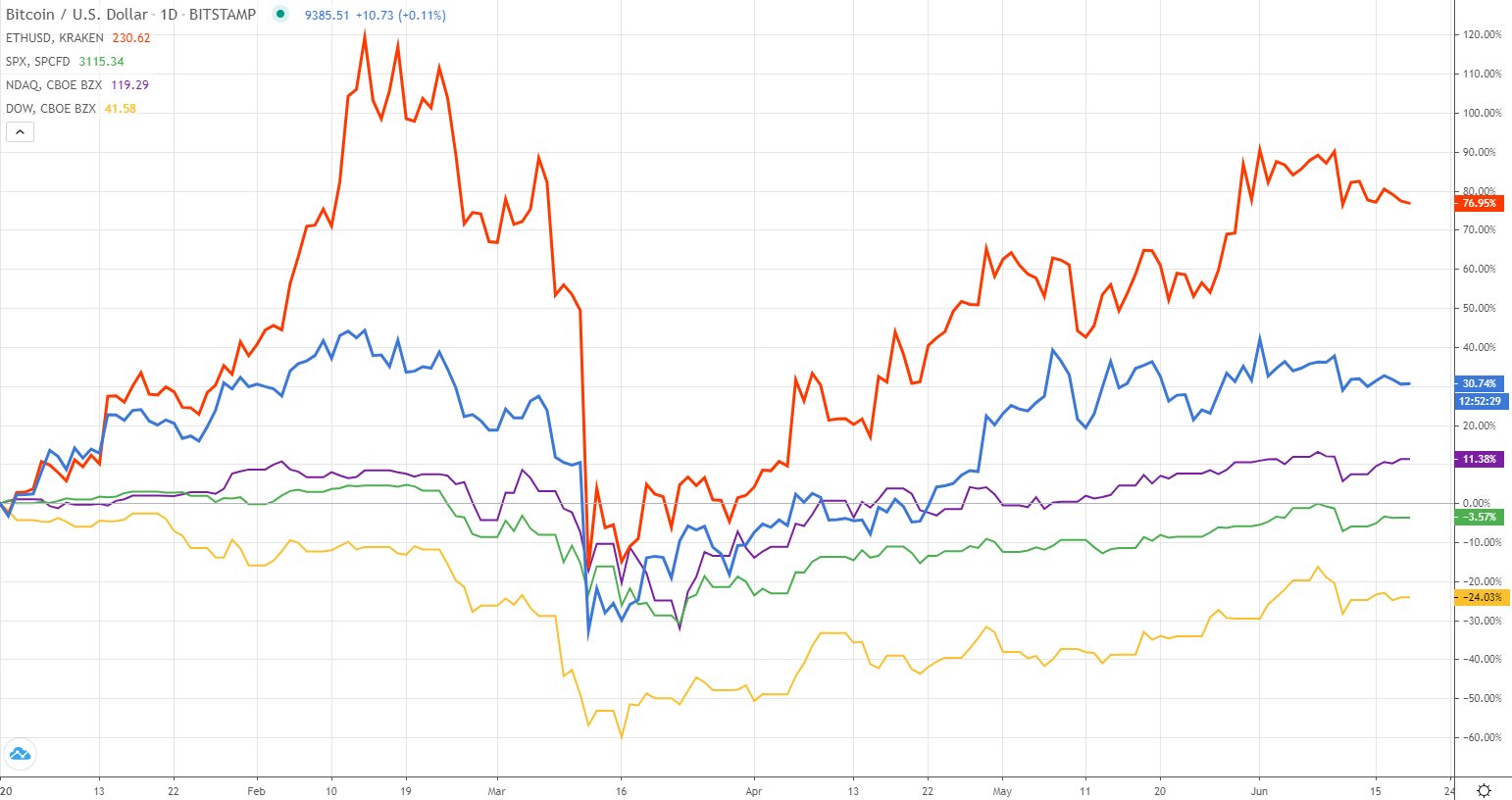

Four months after the financially devastating Black Thursday (March 12, 2020), markets seem to be recovering fuelled by the seemingly unlimited “brrr” power of central bank[st]ers. Like traditional monetary instruments, Bitcoin has staged an astonishing come-back appreciating 30% since the start of the year. Despite its stellar performance, the original cryptocurrency is being outperformed by its closest rival – ether (ETH).

So far in 2020, Ethereum’s native coin has appreciated by the mind-boggling 76%. Ether’s value is not the only metric that has demonstrated strength this year, though. Network usage, as measured in gas, has reached all-time-highs of 61 billion (seven-day moving average), while the number of transactions being executed on-chain is up 45% from January levels.

According to CoinDesk, Ethereum’s performance is most likely fueled by the phenomenal growth of the decentralized finance ecosystem (DeFi) and increased Tether transacting.

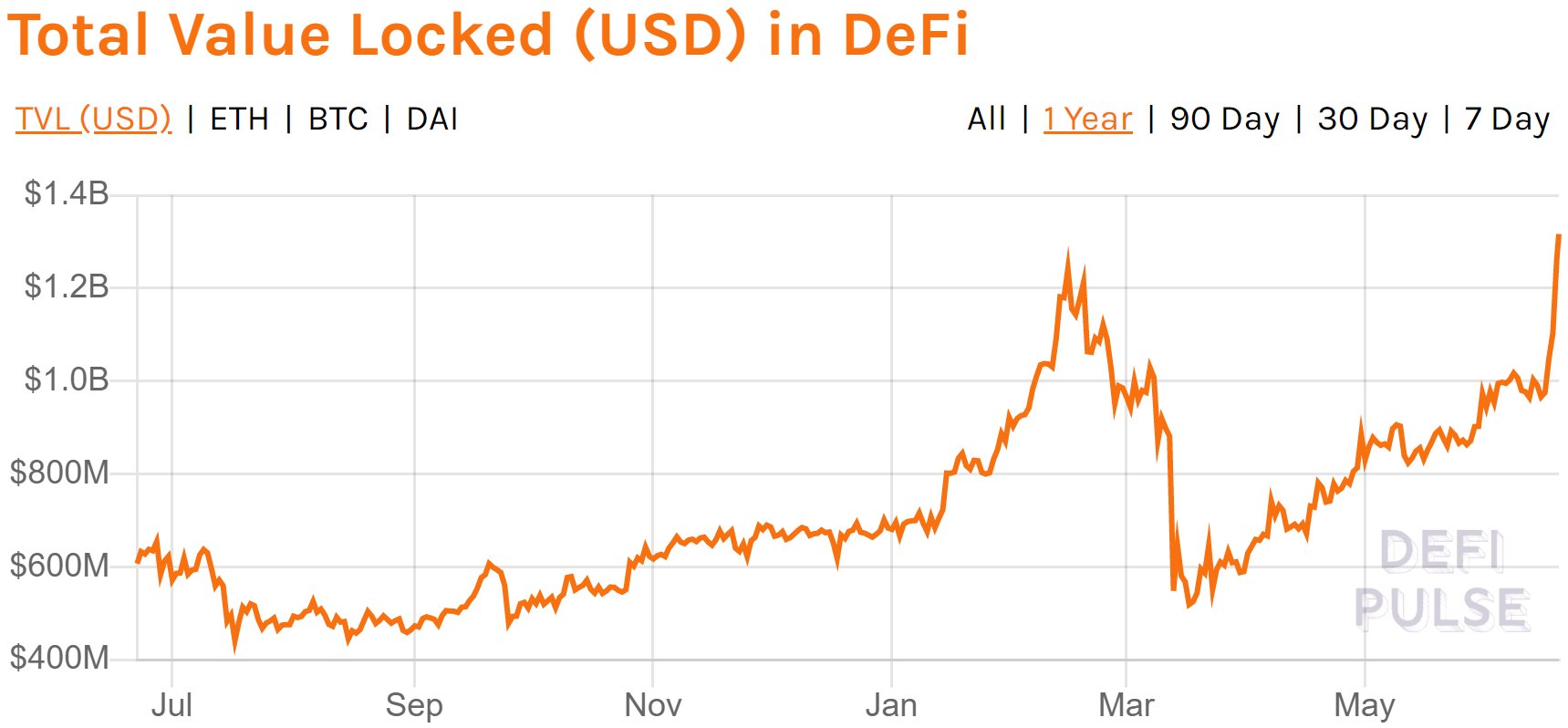

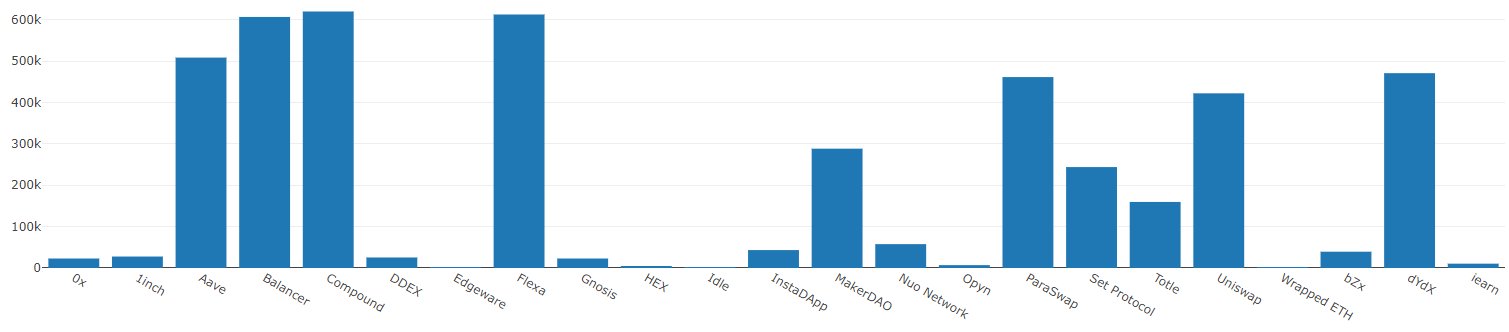

After plummeting in March, the total USD value locked in DeFi dApps is again at ATH levels. The significant June surge, visible in the graph, is attributed to the launch and distribution of Compound’s governance token COMP.

The real-world utility of DeFi protocols, as demonstrated by the growing volumes of liquidity they are attracting, is bringing substance to Ethereum’s smart contract narrative. That improves the project’s value proposition and creates a virtuous cycle where utility fuels investor confidence and vice versa.

With the “DeFi” moniker becoming what “blockchain” and “ICO” were in 2017, entrepreneurs are flocking to the space attracted by the signs of a new wave of (ir)rational exuberance.

As in 2017, the US and off-shore jurisdictions seem to be attracting the bulk of DeFi founders. Nonetheless, Europe is also nurturing its own DeFi community.

Here is the first part of a list of ten DeFi projects that formally call the old continent home.

1. Aave [United Kingdom]

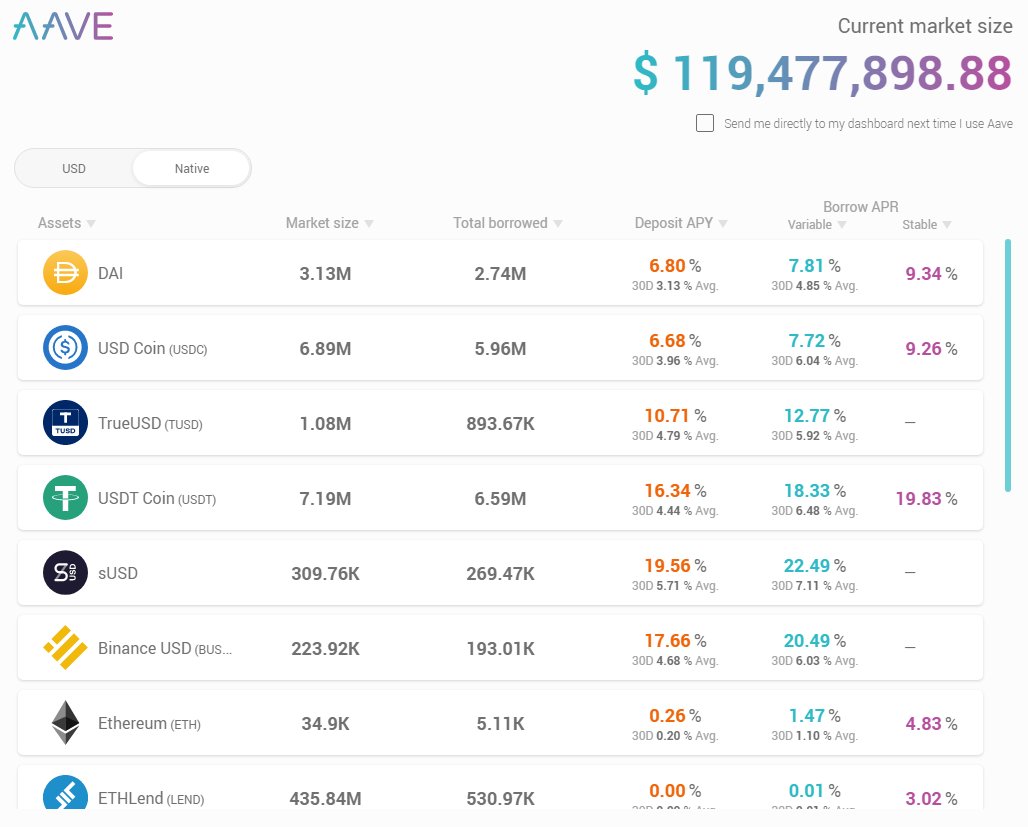

Aave launched in January 2020 as a decentralized non-custodial money market protocol on Ethereum for decentralized lending and borrowing. Users can lend their ETH or tokens for an annual percentage yield (APY), or use them as collateral to take out loans in stablecoins and other crypto assets. Both of these services have proven to be sought after by people in the DeFi space. The project is the European equivalent of Compound.finance (US), with a broader asset set and a flash loan service. Flash loans are trustless, uncollateralized loans where borrowing and repayment of crypto assets must occur in the same Ethereum transaction.

Aave ranks fourth in terms of locked USD value with total offered liquidity currently at $116m. The protocol has been through two security audits in 2019, one by Trail of Bits and one by Open Zeppelin. Before the release of the Uniswap Market in 2020, Consensys Diligence audited Aave’s Constant Product Market Price Provider (CPMPP) Component. The DeFi dApp has an ongoing bug bounty program and so far hasn’t experienced any hacks or unscheduled downtime.

The project currently offers the best lending and borrowing rates (30-day average) for MKR, BUSD, SNX, SUSD, and TUSD. It recently launched a Uniswap market, which will allow Uniswap liquidity providers (LPs) to use their Uniswap liquidity tokens (LTs) as collateral for borrowing other types of assets. LTs are tokens received by users who stake (lock) their crypto assets in Uniswap liquidity pools (to receive a portion of the trading fees).

In the future, when LTs are opened for borrowing, LPs will also be able to receive interest from both Uniswap and Aave. Borrowed LTs could then be used to inflate Uniswap liquidity pools addressing the slippage issue on the one hand, but introducing complex stability risks on the other.

Aave has an OK Admin Key setup, but user funds are accessible by the team.

2. Nexus Mutual [United Kingdom]

Launched in May 2019, Nexus Mutual is a community-owned insurance platform on Ethereum that lets members pool and share insurance risk. The project’s first product is smart contract insurance, which enables users to buy insurance against smart contract hacks or exploits which are all too frequent in the blockchain space. Nexus Mutual covers all smart contract addresses on the Ethereum blockchain that are verified on Etherscan, and users can select the amount and duration of the cover.

Nexus Mutual features a native token NXM that could be used to buy cover, participate in claim and risk assessment, and governance (voting on whether to approve or reject claims). The NXM is not traded on exchanges but could be redeemed for ETH if the ETH in the mutual’s Capital Fund is above the Minimum Capital Requirement (MCR). The MCR establishes the level of capital required to be very confident that all claims can be paid. The higher the amount of value held is above the MCR – the higher the NXM token price is.

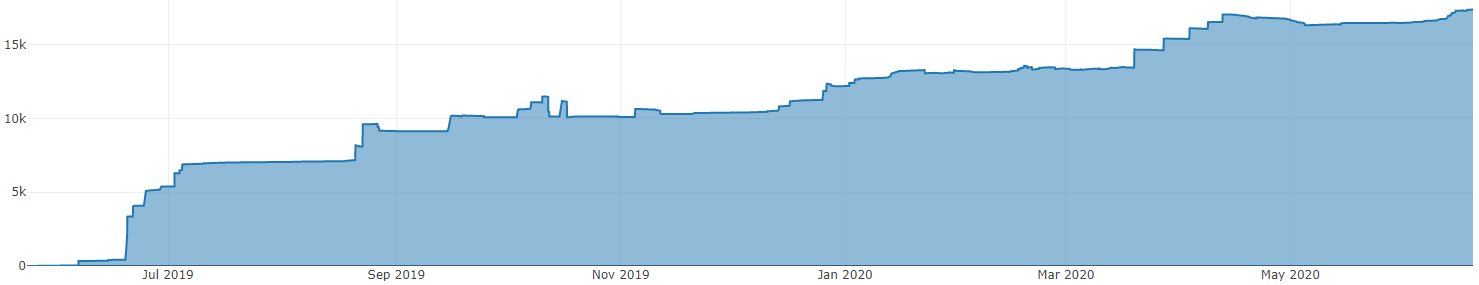

The total amount of funds currently held by the mutual has been steadily rising. It is now at 17371 ETH (~$4m @ ETH = $230), with the NXM token’s price following a similar path.

Currently, a 1000 DAI (1 DAI = 1 USD) insurance on Uniswap protocol’s smart contract, valid for one year, costs 13 DAI. Following the bZx smart contract exploits this year, Nexus Mutual made its first payout of $31k. According to CoinDesk, Nexus can barely keep up with the demand for smart contract cover in the exploding decentralized finance arena.

Below is a chart of the insured smart contracts and the total value of insurance.

Nexus Mutual has a very good Admin Key setup, and smart contract changes are voted on in a GovBlocks DAO.

3. Centrifuge [Germany]

Launched in 2019, Centrifuge enables the underwriting, securitization, and tokenization of real-world assets like invoices, real estate loans, and future streaming royalties for music.

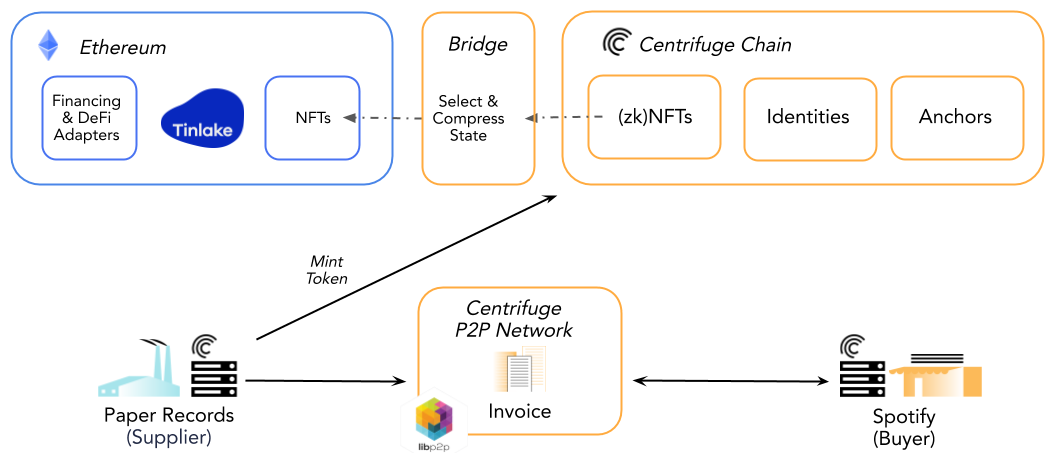

The project’s main stack includes a Proof-of-Stake blockchain platform – Centrifuge Chain (built on Parity Substrate) – that ensures the immutability of information and allows the cost-efficient minting of non-fungible tokens (NFTs), a P2P messaging protocol, an Ethereum bridge, and a set of smart contracts on Ethereum called Tinlake. The project also features an innovative risk-distribution system involving two types of tokens – Drop and Tin – that enables investors to generate interest by lending DAI or USDC in Tinlake.

Once fully operational, Centrifuge will allow a supplier to tokenize invoices that have been approved by a buyer, and use the minted NFTs as collateral for loans in DAI (see the chart above). The loans are provided by investors looking for attractive yields in a decentralized marketplace of asset-backed pools (ex. pools of tokenized invoices). The DAI can then be exchanged to USD and withdrawn or lent in DeFi protocols like Aave or Compound to generate interest.

By originating assets on-chain, Centrifuge is moving more of the world’s value into DeFi. That process will diversify the types of assets that back stable DeFi currencies, like DAI, making them more stable in times of increased market volatility (like March 12, 2020).

It remains to be seen if the financial incentives incorporated in the system will attract users (AKA “asset originators”) and investors. Furthermore, the Centrifuge Chain is currently secured by only 17 peers; its RAD token is not listed on an exchange and has no market price.

A work in progress and more centralized compared to other DeFi projects, Centrifuge promises to streamline the process of on-chain asset origination and initiate decentralization of factoring services.

4. JellySwap [Bulgaria]

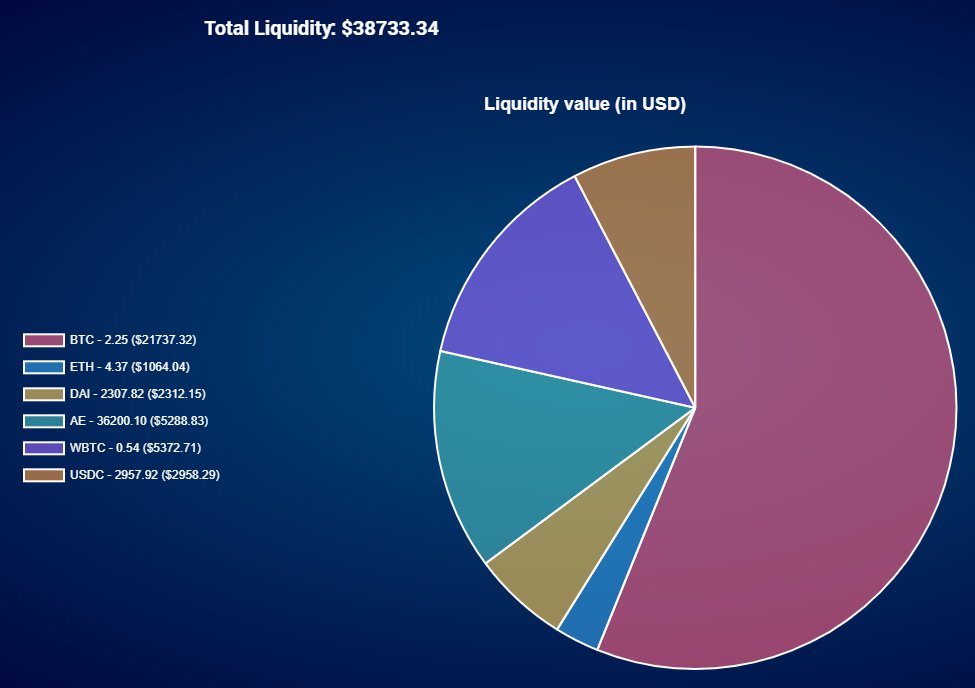

Launched in 2019, JellySwap is a cross-chain atomic swap protocol that enables the exchange of both – tokens and cryptocurrencies. Unlike decentralized exchanges on Ethereum that only support ETH and various ERC-20/ERC-721 tokens, using JellySwap users can trustlessly exchange bitcoins for ETH, DAI, WBTC, and AE (and vice versa). The protocol is fully open-source, and all exchanges on the platform are non-custodial, secure, permissionless, and transparent.

JellySwap’s primary technological innovation is its Hash Time-Locked Contracts (HTLCs) for Bitcoin, Ethereum, and æternity. The contracts enable interoperability between the three public chains in combination with the project’s SDK, market-making bot, and user-interface (for desktop and mobile). The Ethereum smart contract has successfully gone through a code audit, while a Bitcoin HTLC audit is in the works.

Apart from exchanging cryptocurrencies and tokens, users can also provide liquidity to the protocol (locking BTC, DAI, WBTC, AE, or ETH) and earn fees from swaps done using the JellySwap service. That’s also how the company behind the project realizes profit currently – by providing liquidity to its own pools.

Jelly Swap has not organized an ICO but has received funding from Aeternity Ventures and a Singapore investor. The HTLC contracts do not have Admin Key privileges and cannot access users’ funds, modify, stop, or change the contracts’ code.

5. Monolith [United Kingdom]

Monolith is a decentralized banking replacement platform built on Ethereum. It enables users to spend their ETH and ERC-20 tokens in the real-world with a Visa debit card. Put differently, Monolith is a Revolut-like service where fiat currency accounts are replaced by ether and token addresses.

In addition to making payments, Monolith users can exchange their tokens for other tokens thanks to an integration with eight decentralized exchanges. They can also earn interest directly in the mobile app on stablecoins like cDAI and CHAI. In the future, borrowing against collateral in tokens and ETH will also be possible.

In 2017, Monolith (formerly “TokenCard”) organized an ICO and raised $16.7m in minutes. Participants in the ICO received the project’s TKN token, which entitles them to a proportionate share of the funds inside a Community Chest (AKA “asset contract”). Whenever a user tops up their Monolith accounts with cryptocurrency or token different from TKN, a 1% Community Contribution is charged. The charge is forwarded to the Chest, enabling TKN holders to receive part of the profits stemming from the service’s use. However, the asset contract has a balance of only $18.5k, which means that 1000 TKN can claim $4.6 (considering that there are $39.4m TKN tokens).

Paying a 1% charge on all non-TKN deposits and then being subject to all card-related fees and limits is perhaps what is currently impeding Monolith’s wider adoption. The fact that the Visa debit card is only available to residents of the European Economic Area might also be a problem.

Monolith’s smart contracts are open-source and have gone through six security audits (in August 2019). The project’s team does not have access to user funds. It is expected that a European IBAN will soon be added to the list of Monolith account types and will allow automatic conversion to DAI of all received funds – the perfect DeFi on-ramp.

……

Expect the next 5 European DeFi projects in July. Drop us a line if you have ideas about companies/projects that we should put on the list – vlad@bithope.org

If you found this content valuable, follow Vlad Dramaliev on Twitter and follow his column on Trending Topics.