Top 10 Decentralized Finance Projects in Europe [Part 2]

- The growth of Decentralized Finance (DeFi) switched to a higher gear in June, boosted by yield farming and increased investor appetite for risk

- The more notable projects in the space saw their capitalizations skyrocket in a matter of weeks, reminding observers of the ICO boom of 2017

- New DeFi protocols are launching daily, presenting lucrative opportunities for observant go-getters

- In this second part of the series, we look at five European DeFi initiatives that aim to make the space more accessible to both curious newcomers and sophisticated traders

- The reviewed projects include multi-faceted fiat on-ramps/wallets, a decentralized exchange aggregator, and a trustless derivatives platform

Decentralized finance is exploding. In a good way.

ⓒ DeFi Pulse

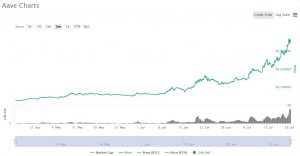

In just three months, the total value locked in DeFi protocols has reached almost 3b USD, while some of the more prominent projects in the space have seen the value of their tokens appreciate as much as 1600%.

ⓒ CoinMarketCap

The DeFi space is capitalizing on the widespread investor glut for risk (and higher returns) that has overtaken traditional financial markets.

Money is being poured into projects that appear to have solid fundamentals and promise to be among the leaders of the DeFi movement. Nonetheless, since their capitalizations have soared in the months after the tempestuous March 12 market crash, investors are on the lookout for fresh opportunities in the space. If the ICO rush of 2017 can provide any clues for the future, the DeFi moniker may become a seal of guaranteed market over-performance during the next crypto bull-run. In fact, initial governance token distributions, usually performed through the innovative idea of yield farming, are the new ICOs. There is no need to buy the tokens (although you can do it on the secondary market), you can “mine” them by supplying liquidity (locking your ETH, stablecoins or other tokens). Yield farming is a brilliant idea that could supercharge DeFi protocols. Look into it by starting here.

But let’s not digress.

As the stellar performance of DeFi projects continues to attract attention, it is high time to explore the space more vigorously (if you haven’t already). A fiat on-ramp and a crypto wallet are necessary prerequisites for that.

The following list of the final five European DeFi projects (look at the first five here) would be a suitable starting point for anyone looking to experience decentralized finance. Let’s dive in.

6. Bancor [Switzerland]

Founded in 2016, Bancor is an on-chain liquidity protocol that enables automated, decentralized exchange on the Ethereum and EOS blockchains. Bancor offers several services dedicated to novice and advanced users, and communities on Ethereum and EOS.

Newbies can utilize Bancor to buy ether (ETH) with a credit card, receive it in the project’s non-custodial crypto wallet, and use Bancor’s decentralized token exchange to swap it for any of the supported Ethereum and EOS tokens (100+).

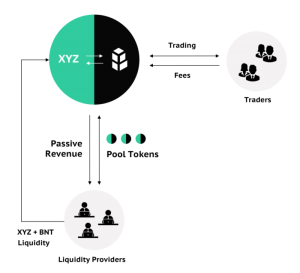

Advanced users can add liquidity to token pools and earn fees anytime a swap is performed.

For projects in the Ethereum and EOS ecosystems, Bancor offers liquidity pool creation, which effectively translates into an exchange listing but without the burdensome red tape. Using the service, token creators can enable the exchange of their tokens by supplying liquidity to both – the maker and taker sides of a trade. All that without going through the standard KYC/AML process required by centralized exchanges (and regulators).

For example, to enable a public market for token XYZ, the project behind it (or its community) can use Bancor to create a pool composed of two tokens: one with 1 000 ETH and one with 1 000 000 XYZ tokens. The fixed ratio effectively determines a public price for token XYZ of 0.001 ETH. Once this open market is launched, the price of token XYZ fluctuates depending on the same fixed ratio vis-a-vis ETH – it goes up if the number of XYZ tokens in the pool goes down, and vice-versa.

In 2017, Bancor raised 153m USD in a token sale, which at the time was the largest to date.

On June 18, 2020, a security vulnerability exposing 500k USD of user funds was identified in V0.6 of the BancorNetwork. The team white-hacked its smart contracts to secure users’ tokens. No funds were lost, although a few automated arbitrage bots profited from the vulnerability but later returned the funds.

The project is currently getting ready to launch the second version of its protocol – V2. It addresses three critical challenges of decentralized liquidity pools and token swaps, namely involuntary token exposure, slippage, and [im]permanent loss.

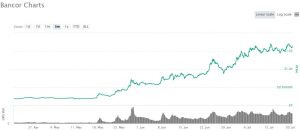

Bancor’s token – BNT – appreciated by 840% since May, 2020.

ⓒ CoinMarketCap

There is no official information about Bancor’s Admin Key setup, but according to a community member, the project retains full control over the smart contracts. Admin Key mismanagement led to a theft of 23.5m USD in July 2019. 10m USD was later recovered.

7. Argent [United Kingdom]

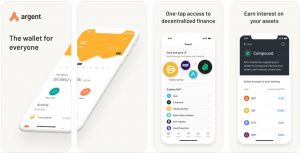

Founded in 2017, Argent is a user-friendly non-custodial crypto wallet with integrated DeFi capabilities. Utilizing Argent, users can send tokens without paying a network fee, buy crypto with Apple Pay, card or bank transfer, earn interest on deposits in-app, and swap tokens using the integrated decentralized exchange.

The Argent team is thoroughly dedicated to improving the user experience of obtaining, managing, securing cryptocurrencies/tokens, and seamlessly interacting with the expanding DeFi ecosystem. The project’s mobile app is one of the best places to start if one is willing to get familiar with decentralized finance. It’s an efficient crypto on-ramp that rivals the user-experience of popular Neobanks like Revolut.

ⓒ Apple App Store

With the convenience and security of crypto-assets in mind, Argent has introduced seedless recovery (no 12/24 words to write down on paper!), biometrics, wallet locking, and daily transaction limits. To further improve user-friendliness, the project has incorporated in-app claiming of names in the Ethereum Name Service, allowing users to send and receive funds using human-readable ETH addresses (yourname.eth).

Although information about Argent’s Admin Key setup is unavailable, according to its support database, the team has no access to user wallets/funds. The project’s smart contracts are also frequently audited.

On June 12, a code review disclosed a vulnerability in the latest version of Argent’s contracts that could have allowed an attacker to initiate recoveries on legacy wallets draining them. The issue was fixed, no funds were lost and OpenZeppelin, a popular smart contract auditor, was awarded a bug bounty.

The Argent project does not feature an ecosystem token.

8. Jarvis Money [Bulgaria]

To be launched in 2020, Jarvis.money is the first synthetic, fiat-based smart contract wallet with integrated banking-like services. It enables users to create, manage, and secure a portfolio of digital assets, and leverage the DeFi ecosystem.

Jarvis is looking to supercharge DeFi mass adoption by offering a fiat currency-denominated mobile wallet with 0-fees, 0-slippage, 0-KYC, and fiat on-ramping (fiat-to-stablecoin swaps). Users will also be able to enjoy subsidized on-chain transactions and human-readable wallet addresses.

The team behind the project is currently researching zero-knowledge proofs and meta-transactions to improve the cost-efficiency and privacy for interactions with the Ethereum blockchain and DeFi protocols. The jarvis.money mobile app is designed to support non-fungible tokens (think tokenized art), will natively integrate lending protocols to enable interest generation on deposits, and will allow users to donate a percentage of the accrued interest to charitable causes.

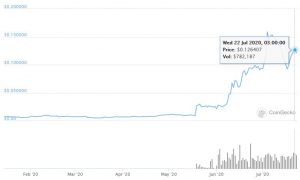

ⓒ CoinGecko

Although it lacks its own token, Jarvis.money is part of the Jarvis Network, which does – JRT. JRT was initially distributed via a token sale at the end of 2018. It has since appreciated by 2400% (1500% in the last three months).

9. ParaSwap [France]

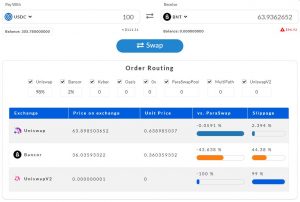

Founded in 2020, ParaSwap is a decentralized exchange aggregator, allowing users to swap their tokens at the best market price. The service acts as a broker that forwards users to the decentralized exchange (DEX), offering the best rate for a particular pair (for ex. ETH/LEND). Analyzing the available liquidity and fees at DEXes, ParaSwap can route a single swap order to multiple exchanges to ensure the best price.

ⓒParaSwap.io

Currently, the service is entirely free and is integrated with Uniswap, Uniswap V2, Kyber, Bancor, Oasis, Curve, 0x, and its liquidity pool – ParaSwapPool. Unlike similar services in the space, ParaSwap has bought insurance to protect its users. If funds are lost during payment or swap operation due to a bug in their smart contracts, users will be reimbursed up to 1000 ETH (~24k USD). The insurance cover is purchased from Nexus Mutual and is visible on the Ethereum blockchain.

In June this year, ParaSwap launched an improved version of its protocol – V2 – that further increases the efficiency of swaps and enhances the developer experience. More than 9000 exchanges have been performed by the aggregator so far.

No information is available about ParaSwap’s Admin Key setup. It is safe to assume that the team has full control over the service’s smart contracts. The project does not feature an ecosystem token.

10. Opium Exchange [The Netherlands]

Launched in May 2020, Opium Exchange is a non-custodial platform for creating, settling, and trading derivatives on Ethereum. The offered derivatives are cash-settled (apart from the gwei one) and include binary options, options, zero ex\ercise price options (ZEPOs), and futures. Options can be used to speculate on both price drops and price increases in a capital-efficient way and are frequently used to mitigate the risk of open spot positions.

Using Opium, traders can bet on the future value of tokens without actually owning them. The supported cryptos include BZRX, COMP, BAL, NXM, ETH, and Ethereum’s gas price. On the other hand, developers can code any futures, options, or CDS contracts, list them on the platform, and make them available for trading to anyone.

ⓒ opium.exchange

Speculation aside, Opium Exchange can help traders hedge against unfavorable price movements. For example, by purchasing the ETH/DAI call option on the platform with a maturity date of July 24, a trader can be confident that they are protected against significant increases in ETH price. That particular call option allows its owner to buy ETH at 240 DAI, irrespective of its market price on July 24. If 1 ETH is worth 280 DAI on that date, the trader will earn 40 DAI (minus fees). No actual ether will be transferred, as the call option is stablecoin-settled.

Each derivative contract that is bought on the platform is represented by a non-fungible (“unique”) ERC721 token that the owner can freely transfer on the Ethereum network. In the future, these tokens will be traded on secondary markets, lent, or used as collateral for loans. For cost-efficiency and to build its order books, the platform utilizes meta-transactions.

Unlike the more popular platform for trading crypto derivatives – Synthetix – in Opium, order execution depends on liquidity. In other words – a trader on the other side of the order book who is willing to match your trade.

There is no information on the Admin Key setup. The smart contracts behind the platform have gone through a security audit by SmartDec in March 2020.

Opium Exchange does not feature an ecosystem token, and the project is realized by private funding and community support.

——-

If you found this content valuable, follow Vlad Dramaliev on Twitter and check his column on Trending Topics.

Drop us a line if you have ideas about DeFi projects that we should review in the future.