What is the State of the European Tech in 2020 After Covid-19?

Exactly one year ago, at the end of 2019, it seemed like the European tech ecosystem was at its height with around $39b of capital invested, close to 180 unicorn companies, and $16b closed by European venture capital funds. Now, at the end of 2020, the European tech industry, being the net beneficiary of the digital shift brought by Covid-19, is about to set a new record of investments that is projected to exceed $41b.

With the goal to present a macro shot of the ecosystem and encourage stakeholders to take further action to realize the potential of European tech, the European VC firm for disruptive technology companies, Atomico, recently released their annual report “The State of European Tech” – the deepest data-driven investigation of the regional tech industry. The extensive data in the report covers everything from the challenges faced by founders and investors during the crisis, the government policies introduced as a response, to the diversity gap in the tech industry, and the new business model trends. To make the information more comprehensible and digestible, we have selected the key takeaways from the report that have significance for the regional CEE and SEE tech ecosystem.

The gap between Europe’s leading and lagging countries – challenge and opportunity

In terms of density, the startup activity varies greatly at the country level with Estonia being dubbed as the European capital for startups – it has near 5 times as many startups per capita as the European average. Estonia’s efforts to build its entrepreneurial environment are paying off and there are currently five domestic unicorn companies with the latest one being Pipedrive after receiving a major investment from Vista Equity Partners.

An interesting trend uncovered by the report is that the denser the startup activity in a country, the greater the level of per capita investment. Having the highest density of startup activity with 865 startups per one million inhabitants, Estonia has $179 invested per capita, which means that the country is relatively underinvested compared to the UK, which has the same capital investment per capita but twice as small density of startup activity. Bulgaria, being one of the countries with the smallest density of startup activity with 81 startups per one million inhabitants, is reported to have $2 invested per capita. Moreover, Bulgaria ranks 29th, after the Czech Republic and before Latvia, in terms of cumulative capital invested since 2016 which is calculated to amount to $88m, with total capital invested in 2020 being only $14m. In general, considering the entrepreneurial and developer talent pool of the CEE region, which is measured by the country of origin of companies that have built leading mobile apps, the CEE countries are underserved from the perspective of investors.

And what are the trends in the different tech industry verticals?

Marketing, Telecom, and Sports tech startups saw some significant absolute increases in capital investment in 2020 compared to last year, but the biggest winner in terms of increase in investment is the healthtech vertical with almost $800m more invested in the sector in 2020 compared to 2019. In terms of the total amount of investment in an industry, however, the fintech and enterprise software startups raised more capital in 2020 than any other vertical.

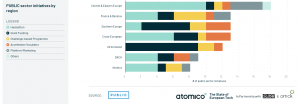

Governments recognize that tech is the motor of growth

To alleviate the damages caused by the pandemic governments across Europe injected around $11b in support to startups, but the report highlights a gloomy trend – close to 65% of the founders are not aware of the Horizon Europe program, which is expected to launch next year and deliver €100b in funding. Interesting differences in terms of public initiatives are uncovered between the different European regions with the governments of CEE countries emerging as the biggest supporters of a tech revival of their domestic economies. The region ranks first in the number of public initiatives launched during the crisis with 10 national “Hack the Crisis” hackathons, designed to find solutions to the most urgent problems created by Covid-19.

The investment appetite of Europe’s tech investors – stronger than ever?

The data from the survey of Atomico shows that the European VC fundraising has remained resilient during the pandemic – 94% of the limited partner investors responded that their appetite to invest in European tech startups has either increased or remained the same. Moreover, the share of VC funding from government agencies has declined to less than 20% in 2020 and a record number of US institutions have participated in investment rounds in Europe throughout the year. In particular, the CEE region, however, still has the biggest share of VC funds raised by government agencies, more than $1000m, while the funds raised by corporate and private investors is respectively near $350m and $200m.

The first decacorns in Europe

2020 marked the $1b valuations of eighteen European tech companies, including Hopin and Pipedrive, and the creation of the first regional decacorns – Klarna and the Romanian UiPath. Intriguing statistics show that Europe is producing unicorns as quickly as the US as seed-funded companies in both regions have around 1% chance of reaching the $1b valuation. These positive trends raise an important question – what happens to the value created by leading European tech companies? The majority of the tech giants transition their value by making an IPO on the public markets with 36% of them making an IPO in Europe and 38% in the US. Additionally, 14% of the tech startups become acquired by US buyers, 8% by Chinese buyers and only 4% get acquired by European buyers.

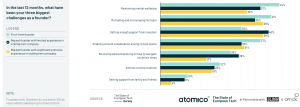

What challenges did the builders of the European tech ecosystem face?

Around 6% of the tech founders and tech startup enablers from the CEE region have taken part in the survey, which was conducted by Atomico to evaluate what were the biggest hurdles brought by the Covid-19 pandemic. The responses of the tech builders show that the crisis’s negative impact on the mental wellbeing of first-time founders was bigger than that of the more experienced ones. This can be, to some extent, explained by the fact that experienced, repeat founders were advantaged by their ability to tap into already established networks for advice and mentorship on how to navigate through the challenging times. At the company level, the biggest difficulties outlined by the respondents were securing access to capital, pivoting their products, managing revenue declines, and maintaining company morale.